Looking to the Futures

Crude Oil

President Donald Trump addressed the nation Tuesday night for his State of the Union Address. The President's focus was largely painting a positive picture of the economy, touting accomplishments on immigration, tariffs, and inflation. Markets reacted positively overall to the President's speech with March S&P 500 Index Futures rising 0.28% to 6923.25, April Gold Futures climbed 0.38% to 5197.2, April Crude Oil were also up 0.38% to 65.88, and treasury futures were lower across the board, with the June 10-year U.S. Treasury notes trading lower .14% to 113'036 (as of 7 AM ET).

While the economy and tariffs drew most of the attention, geopolitical risks still threaten Oil markets and have futures trader's eyes focused on Crude Oil prices. Crude Oil has rallied over 19.5% since the December low of 54.98, hitting a 6-month high on Monday after tensions remain volatile in the Middle East. President Trump last Friday said, he's considering a limited military strike on Iran to ramp up pressure on the country for a nuclear deal. Last Wednesday, Axios reported that here's no evidence of a breakthrough with Iran concerning a nuclear deal. Noting, any military operation against Iran would likely be a joint operation between the U.S. and Israel. The U.S. and Iran are expected to hold further negotiations in Geneva, Switzerland on Thursday. The U.S. president on Tuesday spoke briefly about Iran during his nearly two-hour State of the Union address, stating "We are in negotiations with them. They want to make a deal, but we haven't heard those secret words: 'We will never have a nuclear weapon,' My preference is to solve this problem through diplomacy. But one thing is certain, I will never allow the world's number one sponsor of terror, which they are by far, to have a nuclear weapon."

The American Petroleum Institute (API) last week reported that weekly U.S. Crude Oil Stock rose by 11.4 million barrels in the week ending February 20, compared with a draw of 0.609 million barrels previously. The more widely followed Energy Information Administration (EIA) report will be released later today. A similar crude oil stock build to the API would be the largest build since February 2024. The next OPEC+ meeting is scheduled for March 1, and given the broader market strength, the group is likely to resume supply increases from April. This is despite the oil balance sheet suggesting that the market doesn't need additional supply.

Technicals

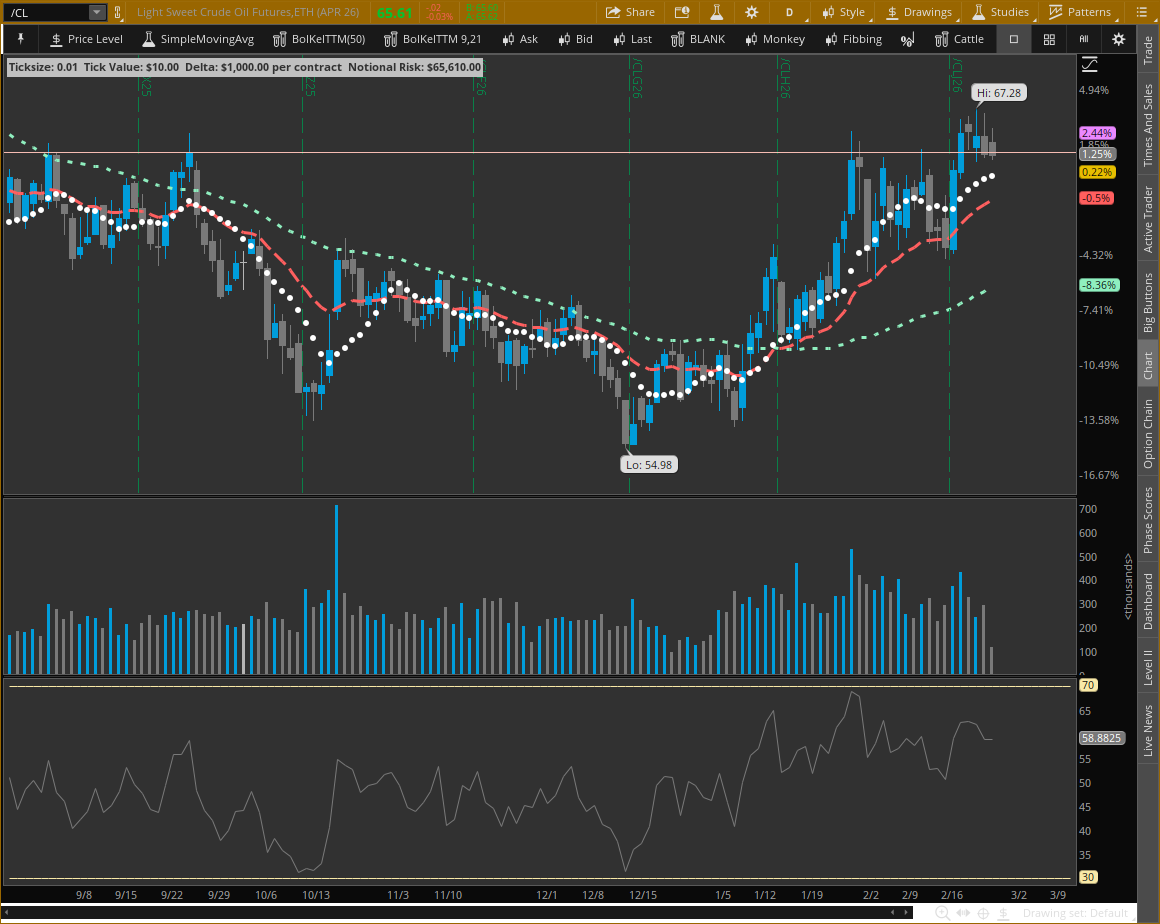

April Light Sweet Crude Oil Futures are trading higher 0.38% to 65.88. The Price Level drawn on the chart at 65.72 represents the close from September 26. Contracts traded at a 6-month low of 54.98 on December 16 and has since rebounded and currently hovers just above that level. The price of Crude has consolidated and formed a flag pattern after a recent gap up from February 18. The price currently sits above the 9-day simple moving average (SMA), 21-day exponential moving average (EMA), and 50-day SMA. There has been a strengthening uptrend since the 9-day SMA and 21-day EMA, crossed over the 50-day SMA on January 14. The relative strength index indicates the future is on the oversold neutral range of 58.2976. According to the Daily Energies Technical Summary from the Hightower Report, the market’s close above the 9-day SMA suggests the short-term trend remains positive. The next upside objective is 67.93. The next area of resistance is around 67.11 and 67.93, while 1st support hits today at 65.51 and below there at 64.73.

9-Day SMA 64.82

21-Day EMA 63.99

50-Day SMA 64.82

14-Day RSI 58.2976%

Contract Specifications

Economic Calendar

- MBA Mortgage Applications 7:00 AM ET

- Fed’s Barkin Speaks 9:35 AM ET

- New Home Sales – Delayed 10:00 AM ET

- Oil Inventories 10:30 AM ET

- Fed’s Schmid Speaks 11:00 AM ET

- 5-Year Note Auction 1:00 PM ET

- Fed’s Musalem Speaks 1:20 PM ET

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- 100 OZ Silver (/SIC)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.