Stocks Sink on Hot December Wholesale Price Data

Published as of: February 27, 2026, 9:19 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,908.86 | -37.27 | -0.54% |

| Dow Jones Industrial Average® | 49,499.20 | +17.05 | +0.03% |

| Nasdaq Composite® | 22,878.38 | -273.69 | -1.18% |

| 10-year Treasury yield | 3.99% | -0.30 | -- |

| U.S. Dollar Index | 97.84 | +0.11 | +0.11% |

| Cboe Volatility Index® | 21.12 | +2.49 | +13.4% |

| WTI Crude Oil | $67.66 | +$2.45 | +3.76% |

| Bitcoin | $66,465 | -$1,305 | -2.00% |

(Friday market open) Pressure returned to Wall Street and volatility flared early Friday as the January Producer Price Index (PPI) report sent another signal that inflation remains untamed, at least on the wholesale side. Headline PPI climbed 0.5% from December and core PPI, excluding food and energy, soared 0.8%, well above consensus of 0.3% for both.

"We continue to think that inflation is in the driver's seat when it comes to monetary policy over the coming Federal Reserve meetings, given the recent stabilization of the labor markets," said Collin Martin, head of fixed income research and strategy at the Schwab Center for Financial Research (SCFR). "This relatively hot PPI report supports the hawks a bit more than the doves as it suggests the next PCE report might come in a bit hot as well." That's a reference to the Personal Consumption Expenditures (PCE) price index, which the Fed monitors closely. Annual PPI growth of 2.9% topped the consensus of 2.6%, with services growth driving gains while goods prices fell. Odds of a rate cut next month were already nil even before PPI, while chances for a cut by mid-year stayed near 50% right after the data, according to the CME FedWatch Tool.

On Thursday, major indexes lost ground as Nvidia (NVDA) plunged 5% despite solid earnings. "Nvidia failing to push to new heights on strong results translates into a poor near-term risk-reward set-up for the AI trade," said Nate Peterson, director of derivatives research and strategy at SCFR. Still, financials, industrials, and small-caps found buyers. Nvidia's drop might reflect worries about mega caps' ability to continue their frenzied chip-buying, concerns about a concentrated customer base, and growing competition. It also seems to reflect growing investor caution across the tech space.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Jobs data ahead could shape rate hopes: PPI—which was hot thanks in part to rising air fares and physician costs—precedes next week's heavy helping of jobs data, notably next Friday's February nonfarm payrolls. January saw a slight monthly revival in job gains, and recent weekly jobless claims have been light, but early analyst estimates for February jobs growth are about half of January's brisk 130,000 pace. Fed speakers this week generally sounded ready to keep rate policy paused after no change at the January meeting, and futures trading indicates virtually no chance of a rate cut anytime soon.. Investors generally expect two to three rate cuts later this year, reflecting the leadership of a new chairman when Jerome Powell's term ends in May. If annual inflation remains at 3%, though, it could set up more conflict between hawks and doves on the Federal Open Market Committee (FOMC).

- Credit worries stay in focus, pushing yields: Credit spreads remain low despite recent jitters in the private credit market. "The worries in the tech sector where some large companies are issuing debt appear overblown, as balance sheets remain strong," said Kathy Jones, chief fixed income strategist at SCFR. The 10-year Treasury note yield dipped below 4% this morning, down more than 30 basis points from January's 4.31% peak. Treasury yields didn't wobble much immediately after the hot PPI data, but an impact can't be ruled out. Treasuries—which move opposite of yields—gained ground recently on worries that troubles in the private credit market might have a broader impact. "There appears to be a new negative headline about private credit every day," my colleague Martin said. "Concerns in the private credit markets are likely the culprit as the risk of spillover to the public markets is pulling investors towards Treasuries, given their perceived safety."

- Chart struggles persist for major indexes: Technically, the S&P 500 Index appears to be out of breath. As one example, it first touched 7,000 intraday on January 28, almost a month ago, but still hasn't managed to close above that. Things were very different when the SPX first touched 6,000 intraday in November 2024. It closed above 6,000 the very next session. The recent reluctance of market participants to push the pedal on the broader market coincides with this week's test of 100-day moving averages for the Nasdaq Composite and Nasdaq-100® (NDX) being rejected yet again. The Nasdaq-100 fell below 25,000 at times Thursday after closing above the 100-day of 25,258 on Tuesday. This type of trading—where a moving average gets taken out and selling takes the market quickly back below it—often results in weak-looking charts that can spark more selling.

On the move

- Netflix (NFLX) soared nearly 8% early Friday after the streaming giant declined to match Paramount Skydance's (PSKY) bid to buy Warner Bros. Discovery (WBD). This makes Paramount the winner of this long war between Netflix and Paramount. Warner Bros. declared Paramount's latest bid the best offer, Bloomberg reported, paving the way for a combined Paramount Skydance and Warner Bros. Discovery. The rally in Netflix indicated investors were pleased the company declined to keep bidding, and Netflix said it will continue investing in its own business. Shares of WBD fell 1.4%.

- CoreWeave (CRWV), a company that rents out AI servers in the cloud, plunged nearly 12% ahead of the open following a quarterly report that featured widening losses and rising debts. Losses last quarter were heavier than Wall Street expected, though revenue came in slightly above consensus. Weak guidance added to pressure on shares.

- AutoDesk (ADSK), a software firm, enjoyed a 2% early rally after earnings exceeded analysts' expectations.

- Dell (DELL) jumped nearly 12% in early trading. The tech firm beat analysts' earnings and revenue expectations for the quarter, lifted by strong demand for its AI server business. Guidance looked positive and the company raised its dividend and announced a share repurchase.

- Block (XYZ) climbed 19% in overnight trading after the company said it's laying off nearly half its workforce, a move affecting more than 4,000 employees, according to CNBC.

- Intuit (INTU) slipped 3.5% despite beating consensus on earnings and revenue and reiterating its full-year guidance. Shares have been under severe pressure early this year along with the rest of the software segment.

- Berkshire Hathaway (BRK.B), which reports earnings tomorrow, barely moved this morning and shares are about flat year-to-date. One question investors often have for Berkshire when it reports is what plans it might have for its massive cash pile. The company hasn't made many large acquisitions in recent years. All eyes will likely be on new CEO Greg Abel as he takes over from Warren Buffett.

- Crude oil (/CL) rose sharply this morning amid continued tensions between the U.S. and Iran. Geopolitical worries may also be weighing on stocks.

- The U.S. 10-year Treasury note yield continued its descent Thursday to just above 4%, a three-month low. This could reflect concern about slowing economic growth, but appeared to help housing as the 30-year mortgage rate fell below 6%. Two Treasury auctions earlier this week drew soft demand, while Thursday's 7-year auction saw "solid" buying, according to Briefing.com, a reassuring sign.

- Financials, industrials, small caps and other cyclical sectors were beneficiaries of late buying Thursday. Airline, cruise ship, apparel, delivery services, home builders, and resort companies were among the market's leaders. This could reflect positive vibes around the U.S. economy, though one day isn't a trend. It also reinforces the rotation from tech into cyclicals that's characterized the last three months.

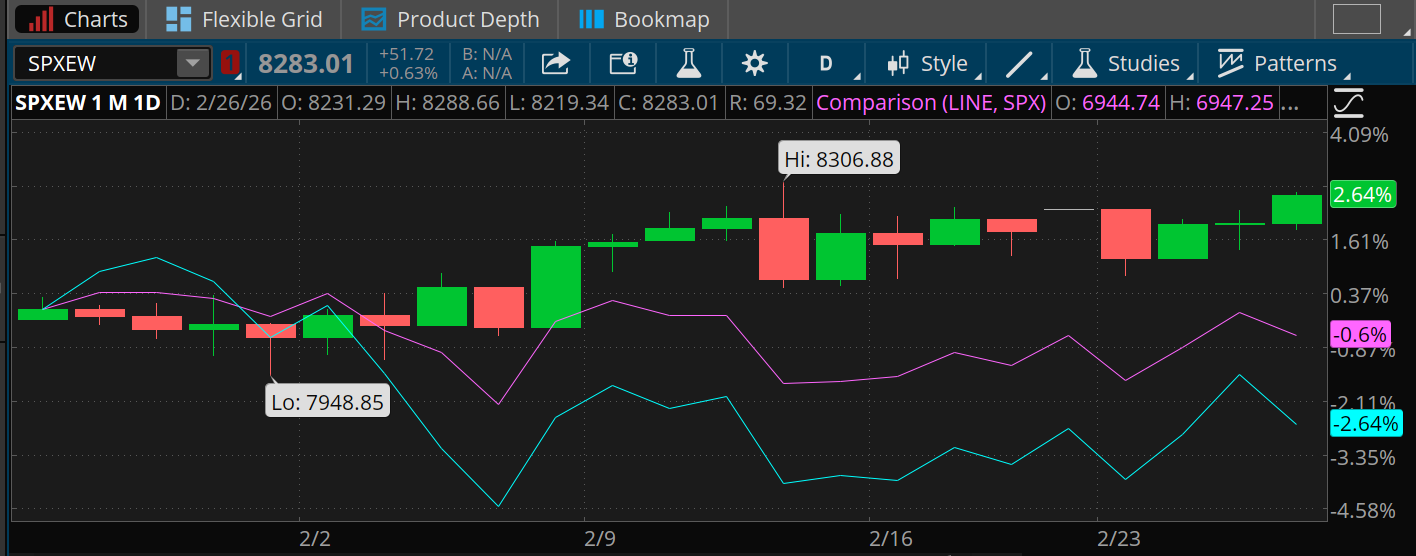

- Though it's been somewhat overlooked amid the relentless focus on AI and software this month, the S&P 500 Equal Weight Index (SPXEW)—which weighs all components the same rather than by market capitalization—climbed more than 0.6% to an all-time closing high Thursday.

- The S&P 500 arrived at Friday flat this week and on pace for a slight decline this month. February is traditionally a weak time of year, so struggles aren't surprising from a seasonal context. The 50-day moving average of 6,900 became a support point late yesterday, but on further declines investors will likely watch the 100-day moving average of 6,830, which has held on recent tests.

- Bitcoin (/BTC) slid 2% early today and traded near the mid-point of its recent range. It's down slightly for the week.

More insights from Schwab

Walk around the markets: Schwab's latest On Investing podcast, featuring Jones and Liz Ann Sonders, chief investment strategist, SCFR, discusses this week's AI-related volatility, the state of the labor market, and the impact of last week's Supreme Court tariff ruling.

Jobs growth can't match GDP: Though GDP growth has mostly been resilient, jobs growth lately turned incredibly weak. Learn more about this apparent puzzle in the latest analysis by Kevin Gordon, head of macro research and strategy at SCFR.

Do gold or stocks shine brighter in hedging inflation? Explore 50 years of price action between gold and the S&P 500 Index to help understand which one tends to work best as a hedge against rising consumer prices. Conditions and time horizon both matter, as explained in Schwab's new investing article.

Chart of the day

Data source: S&P Dow Jones Indices, Nasdaq. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Over the past month, the S&P 500 Equal Weight Index (SPXEW—candlesticks) is up 2.64%, outpacing a 0.6% drop for the S&P 500 Index (SPX—purple line) and a 2.6% drop for the Nasdaq-100 (blue line). The S&P 500 Equal Weight hit a new all-time peak close Thursday as the rotation away from tech continues to lift stocks less exposed to AI.

The week ahead

Check out the investors' calendar for a summary of the top economic events and earnings reports on tap this week.

March 2: January construction spending, February ISM Manufacturing PMI®, and expected earnings from MongoDB (MDB).

March 3: Expected earnings from AutoZone (AZO), Target (TGT), Best Buy (BBY), CrowdStrike (CRWD), and Ross Stores (ROST).

March 4: February ADP Employment Report, February ISM Services PMI®, Fed Beige Book, and expected earnings from Broadcom (AVGO).

March 5: Fourth quarter productivity-preliminary, January factory orders, and expected earnings from Ciena (CIEN), JD.com (JD), Kroger (KR), Costco (COST), and Marvell Technology (MRVL).

March 6: February nonfarm payrolls.