A Touch of Grey During Earnings Season So Far

Key takeaways

- Earnings season is tracking a healthy path so far, but there has been some deterioration and less concentration within the S&P 500® index, alongside more improvement among smaller-cap companies.

- Earnings that beat expectations are not being rewarded as much as in the past, but misses are getting less punished.

- S&P 500 profits represent a powerful but narrower scope of companies, which is why a comparison to a broader corporate profits gauge is instructive.

Fourth-quarter earnings season is underway, with about 33% of the S&P 500 having reported results as of this writing. The "blended growth rate" (combining actual earnings already reported with estimates for earnings yet to be reported) is tracking around 11%. If final results were to end in that vicinity, it would be the slowest quarter for earnings growth in 2025. Growth rates in the first three quarters of 2025 were 13.7%, 13.8%, and 14.9%, respectively.

Sector divergences

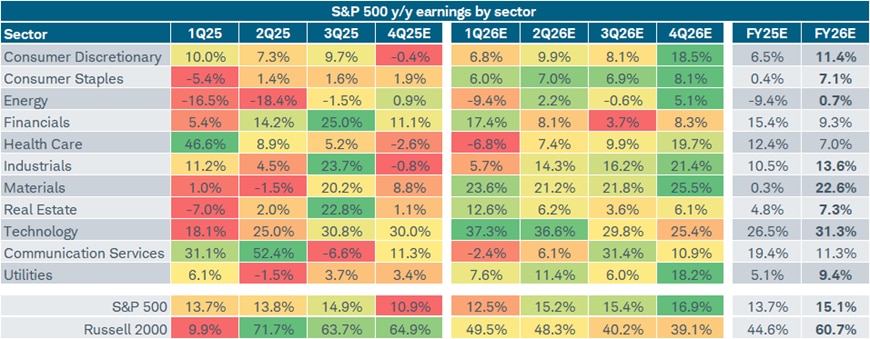

As shown in the table below, growth rates among the 11 S&P 500 sectors have been a mixed bag (as usual), but with a slightly weaker bias. This is shown via the color coding in each sector row from highest rates of growth (green) to lowest/negative rates of growth (red).

Source: Charles Schwab, LSEG I/B/E/S, as of 1/30/2026.

S&P 500 sectors shown. Sectors are based on the Global Industry Classification Standard (GICS®), an industry analysis framework developed by MSCI and S&P Dow Jones Indices to provide investors with consistent industry definitions. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Color scale applied to each sector row with dark green indicating strongest y/y earnings growth and dark red indicating weakest y/y earnings growth. Bolded FY26 percentages indicate higher y/y earnings growth relative to FY25. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results. Dividends and interest are assumed to have been reinvested, and the example does not reflect the effects of taxes or fees.

Looking ahead to this year, the strongest growth rates are expected to come from Information Technology and Materials. Industrials, Consumer Discretionary and Communication Services are also expected to show double-digit earnings growth. Bringing up the rear this year is expected to be Energy sector, with only 0.7% growth in full-year earnings. Also interesting is the direction of travel of each sector's earnings:

- Earnings for the Consumer Discretionary, Consumer Staples, Energy, Health Care, Industrials, Communication Services, and Utilities sectors are generally expected to head higher throughout the year.

- Earnings for the Financials, Real Estate, and Information Technology sectors are expected to generally head lower throughout the year.

- Earnings for the Materials sector are expected to chop around a bit, but in a relatively tight (and strong) range.

For those interested in Schwab's sector ratings, see our monthly stock sector outlook.

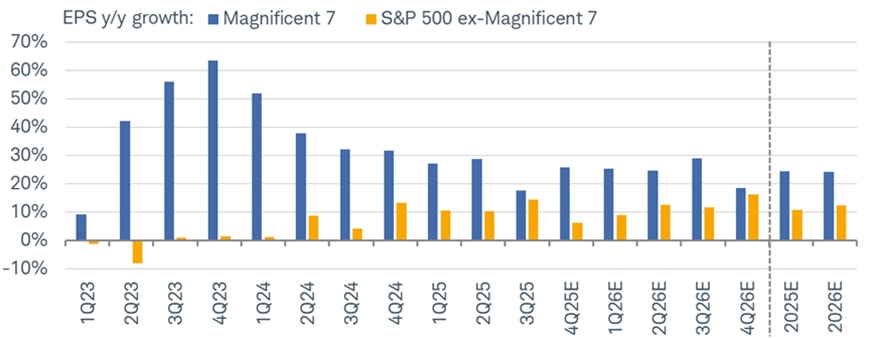

Mag7 vs. other 493 stocks

Another way to slice and dice S&P 500 earnings is to separate the index into its "Magnificent 7" (Mag7) cohort (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) and the other 493 stocks. As shown below, Mag7 earnings growth for the fourth quarter of 2025 is expected to be higher than in the third quarter but then stay flat for the first three quarters of this year, followed by a bounce in this year's final quarter. On the other hand, after an expected bottoming in the fourth quarter of 2025, growth is expected to sequentially expand each quarter this year. Indeed, the growth rate for the Mag7 will remain higher than the rest of the index's constituents, but the direction of travel is important as well. As we often tell investors, "better or worse often matters more than good or bad."

Direction of travel matters

Source: Charles Schwab, LSEG I/B/E/S, as of 1/30/2026.

"Magnificent 7" (Mag7) represents Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla. All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

One important note when looking at the chart above: The third quarter 2025 was a bit of an anomaly as Meta had a very large one-time charge in its results, which severely impacted the Mag7 growth rates. If that one-time item were removed, the third quarter 2025 Mag7 growth rate would have been about 31.6%, higher than the rate shown in the chart above. What that also means, however, is that the consensus expectation is for the Mag7 growth rate to decelerate from there.

What say you, Mr. Market?

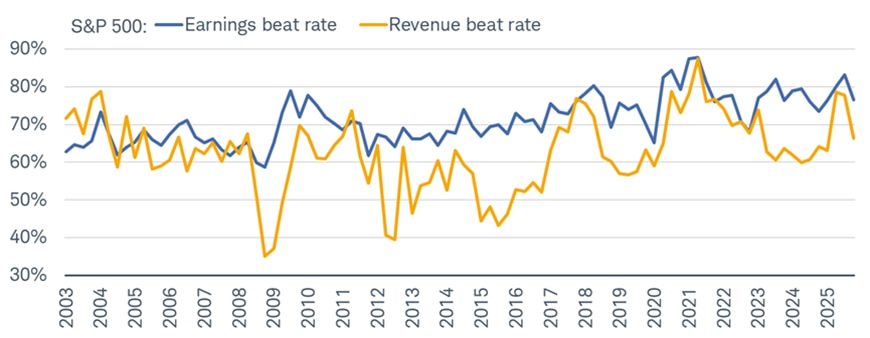

How's the market behaving so far during earnings season? So far, it has been somewhat underwhelming. Of course, there are other macro factors at play aside from just earnings—not least being the announcement of Kevin Warsh as the new Federal Reserve chair nominee and some meme-like moves in the metals space—but earnings haven't been a particularly soothing force.

Some of that can be traced to the decline in "beat rates" for both earnings and revenue. As shown below, the earnings beat rate for the S&P 500 for the fourth quarter of 2025 has slipped to 76.5%, down from 83.1% in the third quarter. Even sharper has been the drop in the revenue beat rate, from 77.8% to 66.3%. These levels are still fairly high relative to history, but a more material rolling over would likely be a warning sign for the market. Weakness in both top- and bottom-line beat rates has been consistent with corrections and, at times, bear markets (most recently in 2022).

Beat it down

Source: Charles Schwab, LSEG I/B/E/S, as of 1/30/2026.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

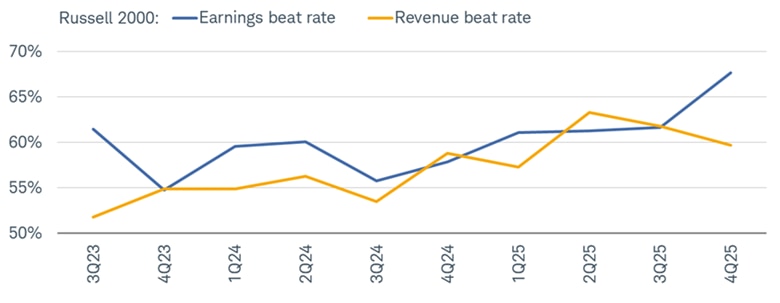

A more compelling story, however, may be getting told by small caps. As shown below, the Russell 2000's earnings beat rate—for which we have limited history—has risen to 67.7%, up from 61.7% in the third quarter. The negative offset is a softer revenue beat rate, which has slipped to 59.7%. Importantly, though, it's still quite strong relative to the past few years.

Smaller caps, larger beats

Source: Charles Schwab, LSEG I/B/E/S, as of 1/29/2026.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

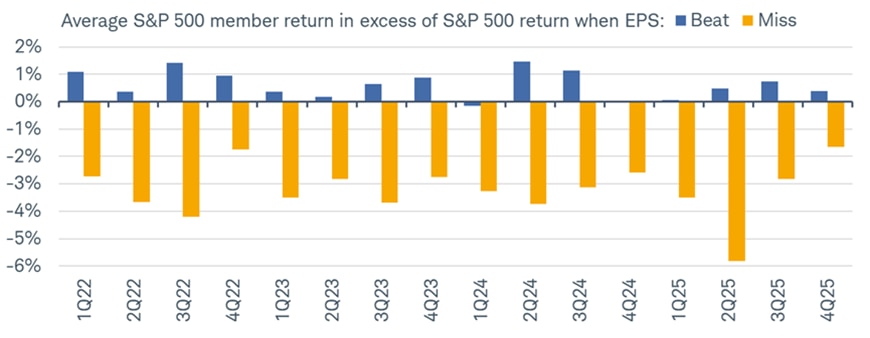

One way to see the market's lack of enthusiasm regarding earnings results is via the chart below. Every earnings season, Bloomberg Intelligence tracks the average performance for stocks relative to the S&P 500 on the first trading day after they report earnings—separating the beats and misses. As shown, companies' average relative performance following a beat is still positive, but the spread is at the weakest since the beginning of 2025. Fortunately, minimal excitement hasn't resulted in harsh punishment when companies disappoint on earnings, given the average performance when companies miss is the "best" spread seen in the past three years.

Lacking enthusiasm, lacking punishment

Source: Charles Schwab, Bloomberg, as of 1/30/2026.

Member performance in excess of S&P 500 based on gain or loss following day in which earnings are reported. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

End all be all?

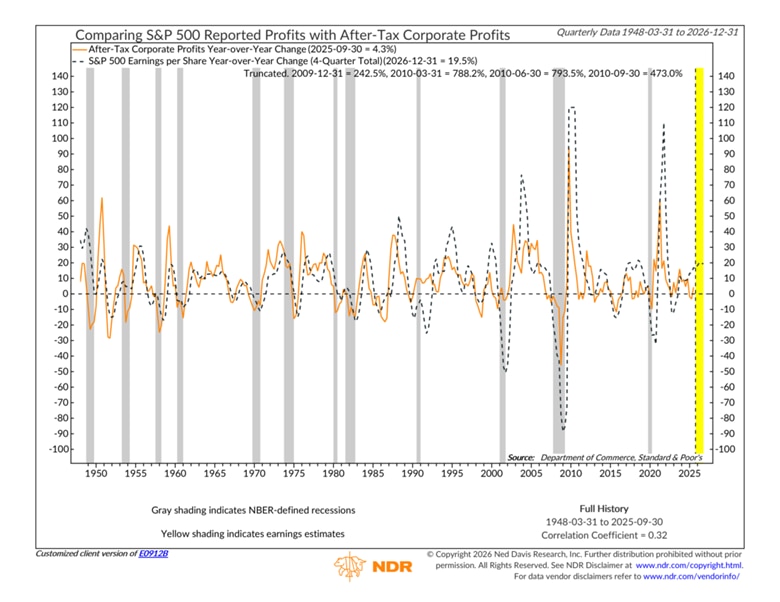

Most investors think of "the market" as the S&P 500 and often think of "corporate earnings" as being from the S&P 500. But the economy is more than just an index of 500 companies. There is a much broader and more comprehensive reading on corporate profitability that gets released alongside each quarter's U.S. real gross domestic product (GDP) release. Corporate profits in the National Income and Product Accounts (NIPA) version are a broader measure of profitability across the entire economy, not just publicly traded index constituents. NIPA-based profits encompass private firms, smaller publicly traded companies, sole proprietorships, S corps, etc. These profits are reported net of taxes and are part of the broader calculation of national income.

Shown below is a long-term look at the relationship between S&P 500 and NIPA profits. The primary differences lie in their scope, calculation methodologies, and the adjustments made to account for different economic factors, such as depreciation, capital consumption, taxes, and global operations. The spread between the two has recently been fairly wide, with NIPA profits having just rebounded slightly from negative territory, and S&P 500 profits comfortably in double-digit territory. As you can see in the chart below, the correlation coefficient is not exceptionally high; however, you will also see that historically NIPA profits lead S&P 500 profits more often than the other way.

S&P 500 profits vs. NIPA profits

Source: Ned Davis Research, Inc., as of 2/2/2026.

Correlation is a statistical measure of how two investments historically have moved in relation to each other, and ranges from -1 to 1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

"Vibepression" persists

The comparison between S&P 500 and NIPA profits helps explain the ongoing disconnect between "soft" (survey-based) and "hard" economic data. Data like the ongoing weakness in consumer confidence may be pressured down by what average economic actors feel day to day (likely more connected to broad corporate profitability), while much of the hard economic data (and certainly the stock market) has been buoyed by the power of the largest U.S. companies.