Crude Tops $100, Sinking Stocks and Treasuries

Published as of: March 9, 2026, 9:18 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

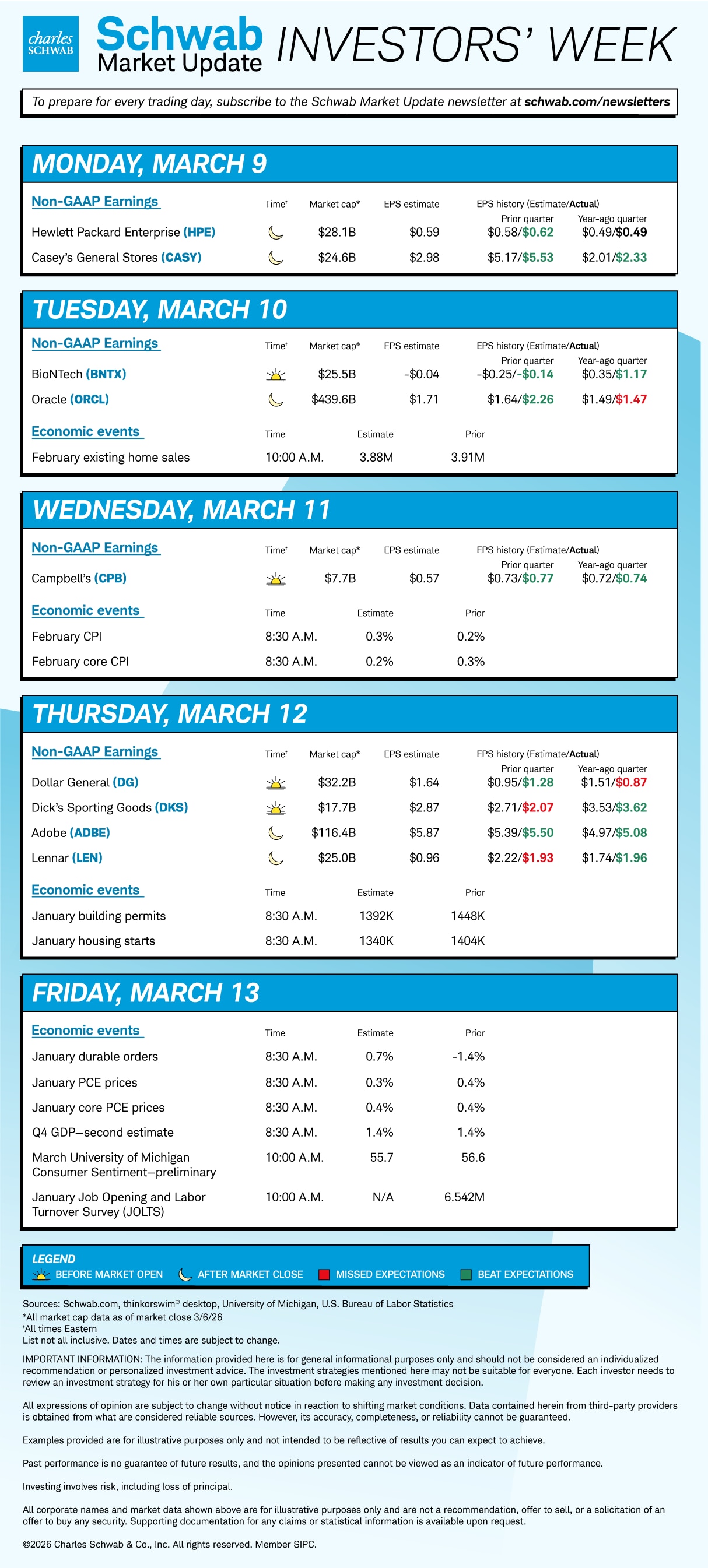

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,740.02 | -90.69 | -1.33% |

| Dow Jones Industrial Average® | 47,501.55 | -453.19 | -0.95% |

| Nasdaq Composite® | 22,387.68 | -361.31 | -1.59% |

| 10-year Treasury yield | 4.17% | +0.04 | -- |

| U.S. Dollar Index | 99.29 | +0.32 | +0.32% |

| Cboe Volatility Index® | 31.52 | +2.03 | +6.88% |

| WTI Crude Oil | $101.87 | +$10.97 | +12.09% |

| Bitcoin | $68,370 | +$75.00 | +0.07% |

(Monday market open) Stocks took another dive early Monday after crude oil prices surged above $100 per barrel for the first time since 2022 and market volatility spiked. Hedging activity ramped up, sending the Cboe Volatility Index (VIX) above 30 for the first time since last April's tariff-fueled leap, and sectors like industrials and financials closely tied to economic growth led early selling. Rising VIX suggests choppier trading ahead, and there are signs that hedge funds may be betting on further pressure as conflict continued and Gulf countries reportedly reduced oil production.

Beyond crude and VIX, the week ahead includes Wednesday's February Consumer Price Index and Friday's January Personal Consumption Expenditures, or PCE, prices—the Fed's favored inflation metric. None of these reports, along with Friday's job openings data, will include any impact from the war. On the corporate side, earnings are light this week, but Oracle (ORCL) tomorrow afternoon could serve as a tech barometer, and Adobe (ADBE) offers another software check Thursday.

On Friday, major indexes dove after crude oil spiked 35% last week and the government reported a surprise February U.S. jobs decline of 92,000. While the data hurt markets Friday, crude and war remain the primary drivers. A test of the November S&P 500 Index (SPX) low near 6,550 seems probable, which would mean falling below the 200-day moving average of 6,582, a line the index hasn't dropped under since May. "Any stability that we might find in oil prices lends stability to the equity market," said Liz Ann Sonders, chief investment strategist at the Schwab Center for Financial Research (SCFR), in a podcast Friday. "In the meantime, we're seeing incredible swings."

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Earnings vie for prominence: The war temporarily distracted Wall Street from earnings when it ultimately could have a big impact. Margins are at risk due to rising energy costs, though transports might be the most obvious companies affected. The cost of oil and natural gas seeps into almost every industry. The thing to watch heading into first quarter earnings next month is whether analysts and companies pare forecasts due to the war and a weak jobs market. FactSet forecasts 11.5% earnings growth for the first quarter and 15% for the full year. Keep those in mind. A dip between now and April would likely indicate companies and analysts expect energy prices to take a bite. Consumer discretionary could be a canary in a coal mine, with many companies in that sector exposed to higher energy costs. United Airlines (UAL) CEO Scott Kirby said Friday that rising fuel prices will have a "meaningful" impact on the company's financial results this quarter, CNBC reported. "The spike in oil prices suggests markets believe the conflict could last longer than initially expected," said Michelle Gibley, director of international equity research and strategy at SCFR. "Keeping production going is important. Even if the war ends quickly, if output is shut in or wells are capped, ramping output back up could mean the impact of higher energy prices lasts longer than the war."

- Treasuries up for a bid: The week ahead includes a handful of Treasury auctions that could help set direction for yields. A 3-year note auction tomorrow and a 10-year note auction on Wednesday could be the most influential. They're the first major auctions since the war began, and weak demand—if that's the case—might suggest investors expect to be paid higher yields to hold U.S. debt amid rising inflation fears. It's unclear how the poor February jobs data might play into auction demand. On the one hand, rising inflation worries could have investors holding out for higher yields. On the other, evidence of a weakening economy might make them more eager to scoop up debt at current levels. "The market continues to grapple between the inflationary shock from the war in Iran and higher oil prices and the potential slowdown in growth," said Cooper Howard, director of fixed income research and strategy at SCFR. "The risk of higher inflation is winning out and pushing rates higher. There are many possibilities with the war but going forward, we don't expect too much downside on longer-term rates."

- Are homeowners feeling less "locked in?" Few signs have emerged that the recent slide in mortgage rates has encouraged existing homeowners to let go of their ultra-low COVID-19-era rates and enter the market, which would provide much-needed supply. A supply scarcity has kept prices elevated and sales weak. Investors will get a fresh look at the housing market this week, when data on existing home sales comes out Tuesday. On Thursday, home builder Lennar (LEN) will report quarterly earnings, and data on housing starts and building permits is due. Average mortgage rates have sat below 6.25% for the past two months, and in late February briefly dipped under 6% for the first time in more than three years. Yet in January, existing home sales fell 8.4% from the previous month to 3.91 million units, the lowest level in more than two years. Extreme weather was likely partly to blame for that, but the Briefing.com consensus for February existing home sales is worse: 3.88 million units.

On the move

- Defense stocks including Lockheed Martin (LMT) and Northrop Grumman (NOC) rose again early Monday as the war showed no sign of calming and President Trump said an end to conflict would require unconditional surrender by Iran. Last week, Trump said defense CEOs agreed to "quadruple production" of wanted weaponry.

- Hims & Hers Health (HIMS) catapulted 47% early Monday on news that Novo Nordisk (NVO) plans to sell its weight loss drugs on Hims & Hers platform, Bloomberg reported.

- Energy stocks rose nearly across the board today with crude topping $100, but the ascent for this sector hasn't been linear. The near complete blockage of the Strait of Hormuz could make it tougher for oil and oil services companies to profit in the near term, as there's less product to sell. Energy as a sector rose less than 1% last week even as crude oil futures mounted their quickest one-week rally in more than 40 years, rising more than 35%.

- Crude (/CL) rallied to nearly $120 per barrel at one point overnight, but calmed somewhat after the Financial Times reported that Group of Seven (G7) countries including the U.S. were considering a joint increase of supplies from their reserves.

- BlackRock (BLK) dove 7.2% Friday and another 1.5% this morning after the asset manager said it had decided to limit withdrawals from one of its private credit funds following a wave of redemption requests in the first quarter, Barron's reported.

- Nvidia (NVDA) and other chip stocks fell again Friday after Bloomberg reported that the Trump administration has written draft regulations that would restrict AI chip shipments to anywhere in the world without American approval. The PHLX Semiconductor Index (SOX) fell more than 7% last week to two-month lows and looked to be under pressure again early Monday but remains higher year-to-date.

- The chip weakness extended Friday across much of the group, with SanDisk (SNDK) and Micron (MU) down nearly 7% and Intel (INTC) falling 5%. Weakness in Asian economies that might be hit hardest by rising energy prices could be a pressure point for the chip market.

- Bitcoin (/BTC), which tends to rise and fall with investor sentiment, rose slightly early today. It slid 4.7% on Friday, though it still climbed slightly for the week.

- The 10-year Treasury note yield fell one basis point Friday to 4.13% but climbed 17 basis points for the week and posted further gains this morning. The weak jobs report weighed more heavily on shorter-term yields Friday, but overall, yields have been on the rise since the war began more than a week ago, hurt by worries that inflation might prove stubborn due to war-driven gas price rallies.

- Materials stocks performed dismally last week, with many key names dropping double digits. This could reflect relative weakness in copper (/HG) and silver (/SI) since the war began. Softness among industrial commodities might indicate concerns that higher energy prices have a chance to slow economic growth, reducing demand for industrial metals. Mining stocks fell again this morning as copper and silver slid further.

- Small caps got rattled and fell nearly 4% last week amid rising Treasury yields that could raise borrowing costs. Smaller companies often are more exposed to debt markets.

- Almost lost in the mix last Friday between the jobs report and war news was a monthly drop in U.S. retail sales. They fell 0.2% in January after stalling in December. Motor vehicle and parts sales and sales at gas stations were among the weakest categories, the government said, along with clothing and accessories.

- Rising oil lifted U.S. gas prices to $3.47 a gallon on average as of Monday, the highest since last April, according to AAA.

- Technically, the S&P 500 Index settled Friday well below long-term support at the 100-day moving average of 6,838, which had held most of the week. It's now below its near-term range of 6,800 to 7,000. However, dip buyers did step in almost every day last week. On Friday, the index bounced off what might constitute a lower support level near 6,720 hit on Tuesday, but that level appears in danger this morning.

- Looking back at last week, the Dow Jones Industrial Average fell 3.01%, the S&P 500 lost 2.02%, and the Nasdaq dropped 1.24%.

More insights from Schwab

Reversal of fortune: While there's no perfect way to tell when a rally is about to peak, several technical signs and chart patterns can provide hints. Learn what they are in Schwab's new look at technical analysis.

Bitcoin questions answered: Schwab's latest video provides an introduction to bitcoin and examines some of the things to consider before investing in it.

Falling rates and implications for borrowers: The Fed reduced rates three times late last year, sparking media discussion about whether now is a good time to refinance or consolidate debt. Learn some reasons why the answer could be complicated in Schwab's newest look at debt management.

Iran FAQ: Our experts answer some of the most common questions about the Iran war's impact on markets in their latest post. One key takeaway: Investors should avoid over-reacting. Geopolitical shocks and crises rarely result in major sustained impacts to global economic growth or financial markets.

Chart of the day

Data source: CME Group, ICE. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Typically, crude oil (/CL—purple line) and the U.S. Dollar Index ($DXY—candlesticks) go their separate ways. A weaker dollar often portends more expensive oil, while a firmer dollar often brings down crude, which is priced in dollars. But the war has provided strength to both amid crude supply worries and perceived "safe haven" trading that's steered investors into the U.S. currency as they fear the war's broader impact, especially on European economies.

The week ahead