Slide Resumes on Tech Weakness, Risk-Off Trading

Published as of: February 17, 2026, 9:08 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,836.17 | +3.41 | +0.05% |

| Dow Jones Industrial Average® | 49,500.93 | +48.95 | +0.10% |

| Nasdaq Composite® | 22,546.67 | -50.48 | -0.22% |

| 10-year Treasury yield | 4.03% | -0.02 | -- |

| U.S. Dollar Index | 97.34 | +0.43 | +0.44% |

| Cboe Volatility Index® | 22.21 | +1.11 | +5.24% |

| WTI Crude Oil | $63.41 | +$0.52 | +0.83% |

| Bitcoin | $67,975 | -$860 | -1.25% |

(Tuesday market open) Lacking much fresh news after a long holiday weekend, Wall Street began Tuesday where it left off—tracking lower. Tech led the march downward, suggesting AI substitution anxiety that dogged trading much of this month hasn't dissipated. "Risk-off" trading persisted with the dollar and volatility up while bitcoin remained weak.

This short week does feature a possible tailwind as the 10-year Treasury note yield dropped to fresh two-month lows this morning at 4.03% after Friday's mild January Consumer Price Index (CPI). A flock of Federal Reserve policy makers speak in coming days, and tomorrow features minutes from the last Fed meeting, perhaps shedding light on the rate pause and the path forward. "Absent a sharp economic slowdown, which is not our base case, we don't see much room for yields to fall much further," said Collin Martin, head of fixed income research and strategy at the Schwab Center for Financial Research, or SCFR. "While inflation's moving in the right direction, it's still a bit elevated, and budget concerns and the rising trend in global bond yields should keep long-term Treasury yields elevated even as the Fed cuts rates later this year."

Wall Street ended mixed Friday, but the S&P 500 Index is down two straight weeks, and the Nasdaq-100® (NDX) has descended three straight. Industries from software to financial services to trucking to real estate suffered lately as investors wrestled with concerns that new AI tools could squeeze demand, though it's unclear how quickly. Speaking of AI, earnings arrive later today from Constellation Energy (CEG)—a beneficiary of the AI data center buildout—and Palo Alto Networks (PANW). Earnings season is tracking a healthy path so far, but there has been some deterioration and less concentration within the S&P 500 Index, alongside more improvement among smaller-cap companies. Walmart (WMT) reports later this week, and crude oil climbed on heightened tensions heading into nuclear talks between Iran and the U.S.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Under the hood: Despite two weeks of losses, market breadth remains healthy with nearly 63% of S&P 500 stocks still above their 50-day moving averages. This means the S&P 500 Equal Weight Index (SPXEW) could provide more insight into the market's path, unaffected by mega-cap weighting. The equal-weight index rose more than 1% Friday and finished up a fraction last week. "The broadening out has legs, but with rapid-fire rotations continuing as a theme," said Liz Ann Sonders, chief investment strategist at SCFR. From a technical angle, the S&P 500 Index hovers above its 100-day moving average near 6,812, a possible support point on any pullbacks. The index closed just two points above that on February 5 but hasn't settled below it in three months. On Friday, the index twice tested the moving average and rebounded both times. The 50-day moving average of 6,894 held resistance on Friday's rally effort, but advancing shares easily led decliners, a positive note. "The bright spot is that the S&P 500 is trying to bounce off the bottom of its trading range," said Nathan Peterson, director of derivatives research and strategy, in his Weekly Trader's Outlook.

- Calm amid AI turbulence: The AI disruption is now in the "cascade" phase which encompasses not just who the beneficiaries are across industries and sectors, but who the disruptors are and who's being disrupted. For a few weeks it was software-as-a-service, or SaaS, stocks and then it hit financial services companies. "It's kind of a sell-first, ask questions, do real research later, kind of backdrop and I would caution investors not to get overly excited when you have a subsegment of an industry or a sector all of a sudden doing well (or poorly)," Sonders said. "Panic or FOMO in the face of these rapid-fire shifts and rotations doesn't make a lot of sense, either. And that continues to be one of the reasons why we've had more of a factor focus (investing based on stocks' characteristics) over a more monolithic sector focus, in part because these sector rotations are happening fast and furiously."

- Focus turns to trade, tariffs, Powell replacement: The U.S. trade balance for December due Thursday might be in the spotlight as it could shed light on how the U.S. trade deficit is being affected by tariffs. After that, Friday could bring the Supreme Court's ruling on President Trump's tariffs. Expectations are for Trump to lose this case, but the administration could quickly find other ways to enforce tariffs if it desires, and the case doesn't affect all the tariffs imposed over the last year. Another Washington development to watch this week is any progress on attempts by the administration to get a hearing for Kevin Warsh, its Fed chairman nominee. The process has been delayed by a spat between Trump and Republican senators who want the criminal investigation of Fed Chairman Jerome Powell wrapped up before they'll consider Warsh. "Warsh's hearing is likely to be in March, but there's plenty of wiggle room because Powell's term as chair does not end until mid-May," said Michael Townsend, managing director of legislative and regulatory affairs at Schwab.

On the move

- Warner Bros. Discovery (WBD) added 2.7% early Tuesday. The company announced it will hold a special meeting of shareholders to vote on the merger with Netflix (NFLX) on March 20. WBD also announced that Netflix has given WBD a seven-day period ending February 23 to allow Paramount Skydance (PSKY) to make its best and final offer. Shares of Paramount rose almost 4% as Warner Bros. said PSKY is open to raising its offer.

- Nvidia (NVDA) slipped more than 0.5% in early trading Tuesday, caught in general tech softness. However, Citigroup issued a positive report on Nvidia, expecting the stock to outperform in the second half of 2026 as AI demand visibility improves into 2027.

- Micron (MU) slipped 2% ahead of the open after The Wall Street Journal reported that Micron plans to spend $200 billion to satisfy data center demands.

- Southwest (LUV) climbed almost 2% in early trading. UBS upgraded shares to Buy from Neutral, seeing upside to the airline's recent moves to provide extra leg room and assign seating.

- Medtronic (MDT) slipped 2.5% this morning despite quarterly results topping expectations. Investors appeared unimpressed by guidance, which includes the expected impact of tariffs, Barron's reported.

- Danaher (DHR) plunged almost 6% this morning on news the health care company plans to buy medical device maker Masimo (MASI) for almost $10 billion, according to The Financial Times. Shares of Masimo leaped 35%.

- Zim (ZIM) soared 35% on news that the Israeli shipping firm is going to be acquired by its German rival, Hapag-Lloyd, for $4.2 billion, Barron's reported.

- Coinbase (COIN) jumped more than 16% Friday following its report of solid trading volume in 2025 along with improved subscription and services revenue. Crypto competitor Strategy (MSTR) rose 8%, while bitcoin (/BTC) added 5% Friday. However, shares pulled back this morning with bitcoin down 1%.

- Palo Alto Networks slid nearly 1% ahead of this afternoon's quarterly results. The stock has struggled lately amid concerns of possible slower demand.

- Consumer stocks generally outperformed the broader market last Friday as yields fell, inflation looked relatively benign, and retail earnings loomed. Leaders included Lululemon (LULU), Dollar General (DG), Disney (DIS), Nike (NKE), Wendy's (WEN), and Target (TGT).

- Cruise lines, including Norwegian Cruise Line (NCLH) and Royal Caribbean (RCL), dipped Friday after JPMorgan Chase downgraded NCLH to Neutral from Overweight, citing leadership changes and diminishing fundamentals. Norwegian changed course this morning and jumped 7% after The Wall Street Journal reported that activist Elliott Investment Management has built a 10% stake in the company.

- Software stocks clawed back from recent losses Friday. Shares of Thomson Reuters (TRI), Salesforce (CRM), and Adobe (ADBE) advanced. Still, 19% of info tech stocks forged fresh 52-week lows last week.

- Home builder stocks rose Friday as Treasury yields fell.

- Defensive sectors utilities and real estate led S&P 500 gains last week, while communication services and financials brought up the rear. Info tech fell nearly 2%. Six of 11 sectors gained last week, but all the ones housing Magnificent Seven stocks fell.

- Gold and silver fell roughly 2% and 4% out of the gate Tuesday, dragging down shares of miners. China's markets are closed for holidays this week, which Barron's notes could sap liquidity in precious metals markets.

- The Cboe Volatility Index (VIX) finished last week above 21, a level near this year's high "which signals that protection is being sought after and/or the potential for higher near-term volatility is above average," Peterson said. VIX finished above 20 in three sessions so far this month, the most since November when it topped 28. The futures market doesn't work in any drop below 20 in coming months, and VIX popped again this morning.

More insights from Schwab

Crypto risks and realities: Schwab's latest Financial Decoder podcast featured an assessment of cryptocurrency and explained what investors need to know about it. Listeners will learn how to evaluate cryptocurrency suitability and risk, and decide if it aligns with their long-term investment goals.

Couples corner: When you have a significant other, it's important to work on successfully navigating your finances together. When you prioritize communication around money and finances on an ongoing basis, it can help improve your relationship, reduce tension, and build trust with each other. Schwab's newest financial planning primer offers tips for couples on everything from budgeting basics to making major financial decisions.

Chart of the day

Data source: CME Group, S&P Dow Jones Indices. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Bitcoin futures (/BTC—red line) have tracked the S&P North American Technology Software Index ($SPGSTISO—cyan line) closely over the past year, particularly in recent weeks, when both sold off. The correlation has generated speculation that investors have begun treating bitcoin and other digital assets as software products.

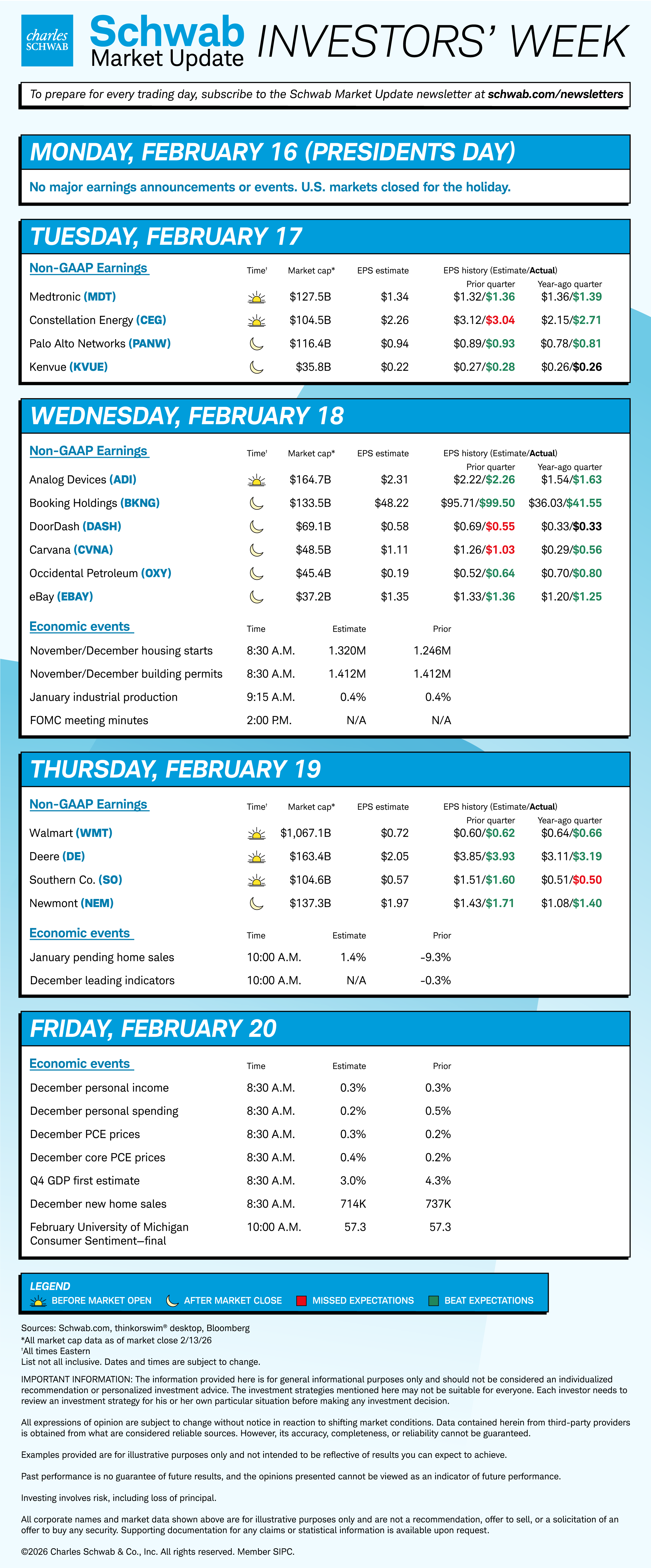

The week ahead