Crude in Control: Stocks Down as Oil Pares Losses

Published as of: March 10, 2026, 9:10 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,795.99 | +55.97 | +0.83% |

| Dow Jones Industrial Average® | 47,740.80 | +239.25 | +0.50% |

| Nasdaq Composite® | 22,695.97 | +308.27 | +1.38% |

| 10-year Treasury yield | 4.12% | -0.01 | -- |

| U.S. Dollar Index | 98.70 | -0.46 | -0.48% |

| Cboe Volatility Index® | 25.07 | -0.43 | -1.69% |

| WTI Crude Oil | $90.39 | -$4.38 | -4.59% |

| Bitcoin | $70,665 | +$1,460 | +2.11% |

(Tuesday market open) After the market reversed sharp losses Monday, the new day dawns with investors mulling mixed messages and major indexes trending lower. Crude remains down following its plunge late yesterday on President Trump's interview with CBS implying the war might not last much longer. Today, crude pared losses and clawed back to $90 per barrel as Trump threatened to hit Iran "20 times harder" if oil stops flowing through the Strait of Hormuz. Bloomberg reported that Iran denied it wants a truce.

Circling back to the home front, tomorrow morning brings the February Consumer Price Index, or CPI, compiled before oil prices spiked. Oracle (ORCL) reports after the close today, bringing data center spending into focus. Still, the war and its impact on crude could trump most other news as far as Wall Street is concerned. "Everything is beginning and ending with headlines out of the Middle East," said Alex Coffey, senior trading and derivatives strategist at Schwab. "Oil is really driving the ship now, and everything will continue to begin and end with crude volatility."

Major indexes climbed across the board yesterday, with the S&P 500 Index erasing early 2% losses on Trump's comments. The index is now down about 1.2% since the war began. On Monday, 433 S&P 500 stocks were lower at one point but the index ended with slightly more components advancing than declining.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Yields, dollar respond to war news: The benchmark U.S. 10-year Treasury note yield is slightly lower this morning but has been a thorn in the side for equities, as Treasuries haven't assumed their normal "safe haven" role in a global crisis. While no investment is safe, traditionally, investors gravitate toward Treasuries at times like this. The difference now appears to be concerns that U.S. debt—already at record highs—could climb further thanks to war-related spending. The U.S. Dollar Index ($DXY) slipped below 99 today after climbing to nearly 99.70 at its peak early yesterday. The dollar has appeared to attract so-called "safe haven" investors since the war began and remains up about 1% for the month but might be losing ground on ideas that conflict could ease. The dollar also has gained on ideas that Europe and Japan could suffer harsh blows to their economies due to pricey imported oil.

- CPI data awaits, but influence questioned: CPI, due at 8:30 a.m. ET tomorrow, is seen up 0.3% monthly and 0.2% for core, which excludes food and energy. Annual core and headline CPI are seen at 2.5% and 2.4%, respectively, unchanged from January. However, all these numbers could be discounted to some extent thanks to ideas that oil could change inflation dramatically. January's benign CPI growth primarily reflected a sharp drop in energy prices, while services-related CPI rose. Chances for a rate cut are around zero at next week's Federal Reserve meeting, according to the CME FedWatch Tool. On a positive note, the New York Fed released a consumer survey Monday showing inflation expectations little changed in February before oil spiked. Looking out three-to-five years, respondents expected inflation of 3% annually. Though monthly inflation data could spike as oil prices reverberate around the economy, keep in mind the Fed tends to watch long-term inflation expectations more than short-term ones. A sharp rise in the longer outlook would likely make policymakers worry that people are starting to price in lasting inflation, as they did in the 1970s, leading to a wage-price spiral. That's almost certainly a bigger concern for the Fed than any short-term—or forgive the expression, "transient"—inflation caused by costly oil.

- Grocery prices could be next to rise: One thing to consider if crude resumes climbing is that Middle East commodities don't just become gasoline and jet fuel. Natural gas is a key ingredient in nitrogen-based fertilizer, meaning lack of progress ending the war could raise food prices, too. This type of fertilizer is "the foundation of modern agricultural yields," Forbes said in a recent article. Roughly half of global food production depends on synthetic nitrogen, without which crop yields would fall sharply, Forbes noted. Back home, the U.S. has become a major producer of natural gas over the last two decades while also lifting crude production to all-time highs—two factors that could help explain why U.S. markets have generally performed better since the start of the war than import-dependent economies in Europe and Asia. Large natural gas companies include ExxonMobil (XOM), Chevron (CVX), and Shell PLC (SHEL). Cheniere Energy (LNG) is a major liquified natural gas company. Most natural gas exported from the Middle East is in the liquified form, and Asian Pacific countries are key destinations for liquified natural gas from the region.

On the move

- Oracle (ORCL) climbed 1.2% early today. Its earnings report this afternoon could serve as a tech barometer. Oracle's recent heavy spending and willingness to take on debt for its AI build-up came under scrutiny in recent months. The question is whether the strategy pays off, and each earnings report could bring more clarity.

- Hewlett Packard Enterprise (HPE) slipped 0.8% in the early going despite quarterly earnings exceeding Wall Street's expectations. Guidance also was in line with estimates, and shares initially rose.

- Nine of 11 S&P 500 sectors finished green yesterday, led by a 1.8% jump for info tech and a 1.1% rise in communications services. Defensive areas like staples and health care also finished in the top five. Energy and financials lost ground, as financials may have taken a hit from suddenly lower Treasury yields.

- Hims & Hers Health (HIMS) catapulted 41% Monday on news that Novo Nordisk plans to sell its weight loss drugs on Hims & Hers platform, Bloomberg reported. Shares rose another 5% this morning.

- CrowdStrike (CRWD) rose 3% this morning after getting upgraded to overweight from equal weight by Morgan Stanley.

- Qualcomm (QCOM) fell more than 2% this morning after BofA Securities assumed coverage with an underperform rating.

- Kohl's (KSS) fell 3% ahead of the open after quarterly revenue came in below analysts' estimates.

- Chip stocks, which had been battered and bruised by the war, among other concerns, rebounded Monday with a nearly 4% jump for the PHLX Semiconductor Index (SOX). Chip leaders included Western Digital (WDC), ASML (ASML), Advanced Micro Devices (AMD), Micron (MU), and Broadcom (AVGO). Nvidia (NVDA) rose 2.7%. Most of the sector advanced further early today, but Nvidia was lower.

- Cruise line stocks, also hurt severely last week by the war and higher energy costs, caught some wind in their sails Monday and mostly rose.

- Gap (GAP) fell nearly 2% Monday, continuing its descent from earnings-related pressure last week.

- Rivian (RIVN) climbed 5% this morning following an upgrade to buy from TD Cowen, which previously rated the stock a hold. The firm sees full scale R2 demand at 212,000 to 335,000 units, suggesting upside to consensus forecasts for 2027, the analyst told investors. The R2 is an electric mid-size SUV.

- Defense stocks including Lockheed Martin (LMT) and Northrop Grumman (NOC) fell 1% yesterday after Trump said the war may be over soon. Both fell today and could serve as barometers of investor thinking regarding length and intensity of the conflict.

- The Cboe Volatility Index (VIX) retreated late yesterday but remained above 25, a level that can indicate elevated uncertainty and possible choppy trading ahead.

- In data today, existing home sales are due at 10 a.m. ET. The Briefing.com consensus is 3.88 million units on a seasonally adjusted annual basis.

- Crude (/CL) dropped 4% this morning as investors monitored the Middle East situation. Group of Seven (G7) ministers meet again today to discuss a possible coordinated release of crude supplies from their stockpiles. They failed to reach an agreement yesterday.

- Bitcoin (/BTC), which tends to rise and fall with investor sentiment, climbed Monday but remained below $70,000. It was up again by 2% this morning and back above $70,000, lifting shares of crypto-oriented stocks. The low of $60,000 a month ago appears to have held for now.

More insights from Schwab

Latest insight on war's impact: Our new update on the war from Schwab experts walks investors through possible impacts on global equities. Most likely outcomes could either be a relatively quick transition from major military operations to negotiations or a gradual de-escalation. However, downside risks rise meaningfully in scenarios where global energy supplies face prolonged disruption with potential spillovers to global growth, inflation, and tightening financial conditions.

Bouncing back: If you recently suffered a big trading loss, it might have dented your confidence. Read our six-point plan that will help you learn from mistakes and begin trading again.

Risk/reward ratio: Our new portfolio management article explains the Sharpe ratio and how to calculate it. The Sharpe ratio is one of the most widely used calculations for measuring risk-adjusted returns. It's most frequently used to evaluate mutual funds, ETFs, and individual stocks, but it can be applied to any investment or portfolio.

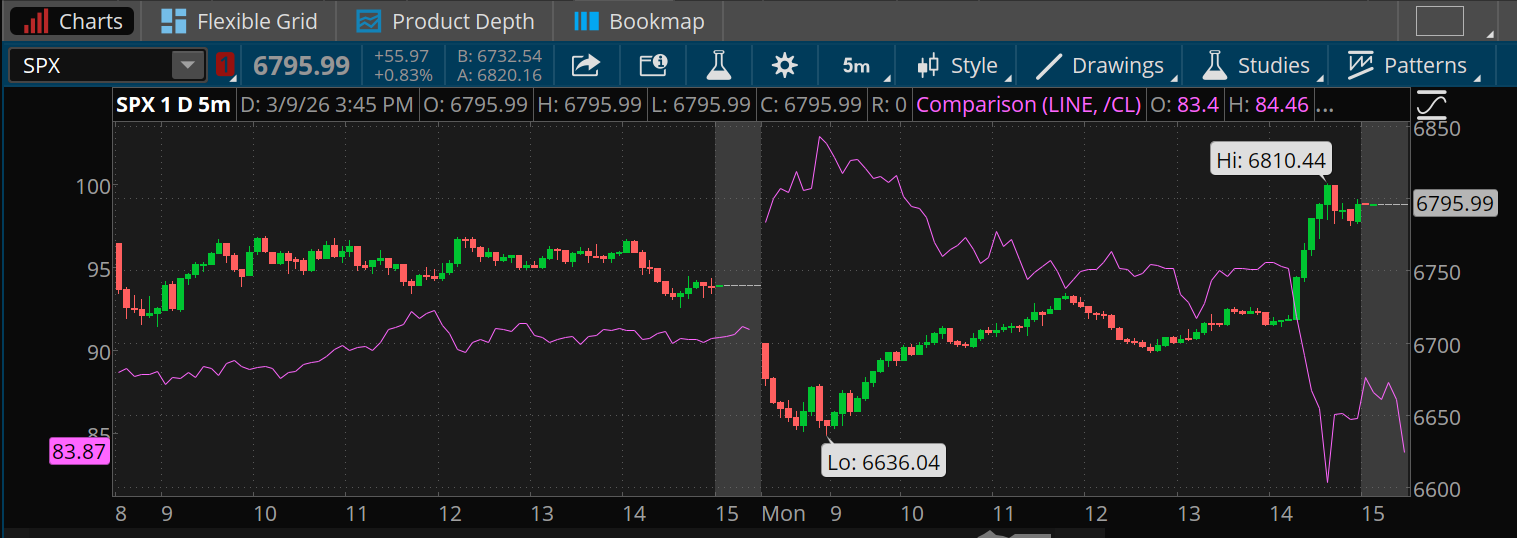

Chart of the day

Data source: S&P Dow Jones Indices, ICE. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Yesterday's wild session included a sharp early descent for the S&P 500 Index (SPX—candlesticks) to below 6,700. This followed overnight trading in which the index tested its 200-day moving average of 6,586. The market then enjoyed a sharp rally, climbing almost 100 points in the final hour of the session as crude (/CL—purple line), which neared $120 overnight, plunged to as low as $82.

The week ahead

Check out the investors' calendar for a summary of the top economic events and earnings reports on tap this week.

March 11: February CPI and core CPI and expected earnings from Campbell's (CPB).

March 12: January factory orders, January housing starts and building permits, and expected earnings from Dollar General (DG), Dick's Sporting Goods (DKS), Adobe (ADBE), and Lennar (LEN).

March 13: January PCE, Q4 GDP second estimate, University of Michigan preliminary March Consumer Sentiment, and January Job Openings and Labor Turnover Survey (JOLTS).

March 16: February industrial production, and expected earnings from Dollar Tree (DLTR).

March 17: Expected earnings from lululemon (LULU) and DocuSign (DOCU).