Looking to the Futures

Corn Pushes Higher Despite Export Shock

May expiration Corn Futures (/ZCK26) staged a late day rally on Thursday settling up roughly +0.34% at $4.43 ½, overcoming a morning decline due to a weekly export report surprise. The USDA released their latest export sales report Thursday morning, covering the week through February 19th, which showed uninspiring sales for the yellow crop.

According to the report, roughly 27.5 million bushels of old and new crops were exported last week. For reference, one metric ton which corn is also commonly measured in, is equal to approximately 39.368 bushels of corn. This 27.5 million came up well short of analyst estimations that total sales would range between 35.4 – 70.9 million. Old crop sales plummeted 53% week-over-week and were 56% below the previous four-week average. Mexico sat at the top of the buyer list, purchasing roughly 373,600 metric tons. Despite this weekly drop, cumulative sales for the 2025-2026 marketing year remain higher than the pace of the previous year's, with 1.509 billion bushels sold thus far.

Corn markets will be intently watching the planting progress of the safrinha corn crop in Brazil over the next couple weeks. Entering peak planting season for this region, roughly 55% of the crop is typically planted by February 21st and increases to 85% by March 7th. There have been mixed signals for precipitation across Brazil through the rest of February which could affect the planting and determine if the crop can get off to a good start or not.

More locally, the U.S. congress has been attempting to resolve a stalemate over policy to potentially lift the seasonal restriction on the sale of E15 fuel (15% ethanol) which would result in more ethanol in American's gas tanks. If lifted, this could be beneficial in boosting the ethanol industry and corn demand domestically. Talks have stretched past the group's self-imposed deadline and remain ongoing as of late February to see if concessions can be ultimately made soon.

Across the broader market, stock indexes experienced downward pressure on Thursday as the March E-mini S&P futures (/ESH26) retreated -0.56% and the March E-mini Nasdaq futures (/NQH26) fell -1.22%. Continued concerns around an AI bubble and AI market exhaustion weighed on chipmakers and Nvidia's earnings after market close on Wednesday failed to ease these apprehensions. Markets were however able to close off the lows, finding support from news around progress being made between the U.S. and Iran regarding a nuclear deal and the release of U.S. weekly jobless claims. According to the foreign minister of Oman who is mediating these nuclear discussions, he stated Thursday that talks will continue next week but that "significant progress" was made this week in Switzerland. U.S. weekly jobless claims came in lower than expected as claims rose by +4,000 to 212,000, lower than the 216,000 projections. This report may help to build hope that future rate cuts could be coming with a strengthening labor market coinciding with potentially lower inflation.

Technicals

Looking at the daily chart for /ZCK26, prices closed higher Thursday in what has been a solid week for the crop future. After the gap up to begin the week, price has remained above the 20, 50, 100, and 200-day Simple Moving Averages. Will be interesting to see if price continues to trend upward and test what appears to be recent resistance around the 453 level where it was rejected multiple times late last year. The 14-day RSI closed at 63.4242, indicating moderately bullish momentum but not yet at overbought levels. Volume on Thursday was higher than the 50-day average with 261,096 contracts traded. The 50-day average sat at 175,348. According to the Daily Hightower Report, /ZCK26 may experience support at the 440 ¾ and 437 ¾ levels and resistance at the 446 ¼ and 448 ¾ levels. May corn open interest as of February 25th was down 14,323 contracts.

20-Day SMA: 431.34

50-Day SMA: 434.16

100-Day SMA: 432.81

200-Day SMA: 428.72

14-Day RSI: 63.4242

50-Day Volume Avg: 175,348

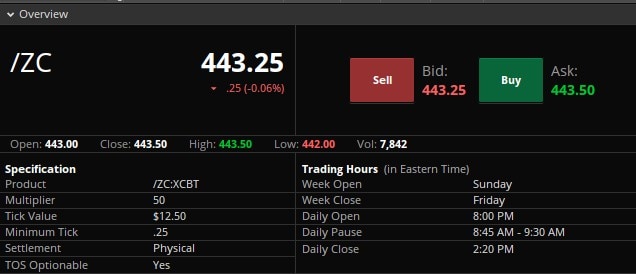

Contract Specifications

Economic Calendar

8:30 AM ET: Producer Price Index (delayed report)

8:30 AM ET: Core PPI

8:30 AM ET: PPI Year Over Year

8:30 AM ET: Core PPI Year Over Year

9:45 AM ET: Chicago Business Barometer (PMI)

10:00 AM ET: Construction Spending (delayed report)

10:00 AM ET: Construction Spending

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- 100 OZ Silver (/SIC)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.