Stocks Dip on Soft Jobs Data as Sector Trends Eyed

Published as of: July 2, 2025, 9:13 a.m. ET

Listen to this article

Listen here or subscribe for free to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® index |

6,198.01 |

-6.94 |

-0.11% |

| Dow Jones Industrial Average® |

44,494.94 |

+400.17 |

+0.91% |

| Nasdaq Composite® |

20,202.89 |

-166.84 |

-0.82% |

| 10-year Treasury yield |

4.29% |

+0.04 |

-- |

| U.S. Dollar Index |

96.95 |

+0.13 |

+0.14% |

| Cboe Volatility Index® |

17.21 |

+0.38 |

+2.20% |

| WTI Crude Oil |

$66.18 |

+$0.73 |

+1.12% |

| Bitcoin |

$107,820 |

+$2,070 |

+1.96% |

(Wednesday market open) Major indexes slipped early on weak jobs data as investors braced for tariff and budget deadlines. Private-sector job growth fell 33,000 in June, the first decline in more than two years, according to the ADP National Employment Report. Analysts had expected a 100,000 increase. Softness in services sector jobs and at smaller businesses capsized the data. "Tomorrow's nonfarm payrolls report will be more important, but this suggests the labor market is softening," said Kathy Jones, chief fixed income strategist at Schwab.

In Washington, the House needs to vote on the Senate version of the budget bill passed Tuesday, hoping to send it to the president by Friday. But passage isn't a slam dunk. "The Senate changes to the bill that the House passed in May are substantial," said Michael Townsend, managing director of legislative and regulatory affairs at Schwab, "and both conservatives and moderates have concerns. But intense pressure from the White House is likely to push the bill across the finish line." Also, the 90-day "reciprocal" trade deadline is next Wednesday and Barron's reported President Trump threatened Japan with tariffs of between 30% and 35%.

Tesla (TSLA) is expected to report second quarter deliveries today, with consensus around 393,000. That's down 11% from a year ago but up 17% from the first quarter. Tesla was among many mega-caps losing ground yesterday as the new quarter began. Investors veered away from big tech and the Magnificent Seven but piled into health care, materials, and small caps. The S&P 500 index slipped and the tech-heavy Nasdaq Composite ($COMP) suffered moderate losses Tuesday. Meanwhile, Treasury yields swung higher this morning despite the weak jobs data, possibly on worries the budget bill could increase U.S. debt.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Population trends, participation under scrutiny as jobs data approach: Tomorrow's 8:30 a.m. ET June nonfarm payrolls report comes as analysts note that less new job creation is needed to keep up with population growth, with immigration down sharply this year. Monthly jobs growth below 100,000 might be seen as weak on Wall Street but would have to drop well below that to raise unemployment, according to some analysts. Separately, labor force participation fell sharply in May and could be watched again for more signs of slippage With the labor force falling, the unemployment rate is less likely to rise, but if people remove themselves from consideration, it could mean frustration. On another note, continuing jobless claims have been at three-year highs for several weeks, suggesting hiring has weakened. Any number above 250,000 for initial claims or 1.95 million for continued claims tomorrow could get a fisheye. May job openings reported yesterday outpaced expectations and layoffs fell in today's Challenger job cuts report, possibly positive signs. Analysts expect jobs growth of 120,000 and unemployment of 4.2% in tomorrow's report. May jobs growth was 139,000. As always, investors should look beyond the headline for revisions to prior reports for the full picture.

- Second half starts with rotation out of tech: Tuesday saw a big rotation into other sectors after tech and communication services dominated the leader board last quarter. It's unclear if it's a one-day event or the start of a trend, but sector performance could provide clues. One source of pressure on tech might have been the Senate's budget bill not including an effort to prevent U.S. states from regulating AI. The measure was a big priority for tech firms and had support from the White House. With tech and communication services taking a breather Tuesday, nine other sectors finished up, reinforcing ideas that the rally is broadening amid rising breadth. It was a variety show with materials, health care, energy, and staples filling the top positions. While that may sound defensive, consumer discretionary popped more as several retail stocks including Nike (NKE), Target (TGT), and Kohl's (KSS) advanced. Fast food, travel-oriented firms, and home builders also climbed. So did railroad and shipping firms, with the Dow Jones Transportation Average ($DJT) up about 3% to nearly four-month highs. Around 75% of S&P 500 stocks rose yesterday, but the index ended lower due to mega-cap weakness. The S&P 500 Equal Weight Index (SPXEW), which weighs stocks equally rather than by market capitalization, added more than 1% yesterday versus a 0.11% drop for the S&P 500 index.

- Soft data catching up to hard numbers: The theme earlier this year was weakness in so-called "soft" data like consumer sentiment and consumer confidence despite relatively solid "hard" data like retail sales and jobless claims. Recent signs point to a switch, as sentiment appears to be improving even as the hard numbers in housing, jobless claims, and personal spending get worse. The housing market is exhibit one, with building permits and new home sales falling in the most recent reports. Then there's soft inflation data that's been welcomed by the stock and Treasury markets but could reflect falling consumer and business demand. Tomorrow's nonfarm payrolls report, if solid, could push back some of the economic worries. If the economy truly is slowing, that might mean less strength down the road for so-called "cyclical" sectors like industrials and financials that were among the first half leaders but could signal better performance for Treasuries and defensive sectors like staples and health care.

On the move

- Nvidia (NVDA) and other Magnificent Seven stocks, hurt by the rotation out of big tech and communication services names yesterday, were mostly down again in early trading today.

- Apple (AAPL) climbed 1% ahead of the open after getting upgraded to Hold from Underperform by Jefferies. The firm noted strong recent iPhone sales and hopes for strong earnings.

- Tesla inched up 0.6% in early action ahead of expected deliveries data. Shares tumbled more than 5% yesterday after President Trump threatened to cut subsidies for CEO Elon Musk's businesses.

- Netflix (NFLX) gained 0.65% ahead of the open after The Wall Street Journal reported it's considering partnering with Spotify (SPOT) on music award shows or live concerts.

- Bitcoin (/BTC) climbed 2.1% early Wednesday and crypto-related stocks Coinbase (COIN) and Strategy (MSTR) advanced after both fell sharply yesterday. Circle Internet Group (CRCL), which rose more than 6% on Tuesday in a comeback from recent selling, slipped slightly early today.

- Nike, Best Buy (BBY), and Macy's (M) were among the retail firms advancing 5% or more yesterday as investors shifted at least for one session to stocks that received less love in the second quarter. All three were slightly higher this morning.

- Verint Systems (VRNT) rose 7.4% on a Bloomberg report that a private equity firm was negotiating to potentially acquire it.

- General Motors (GM) and Ford (F), which both rose sharply Tuesday, inched up in pre-market trading. U.S. total vehicle sales data are due today after dropping to a seasonally adjusted annual rate of 15.65 million units in May and missing analysts' expectations.

- Shares of large U.S. banks generally climbed ahead of the open after several announced dividend increases or share buyback plans following their businesses passing the Federal Reserve's "stress tests." Bank of America (BAC) and JPMorgan Chase both rose 0.5%.

- Adobe (ADBE) dropped 1.4% after getting downgraded to Sell from Neutral by Rothschild & Co. Redburn.

- Centene (CNC) plunged more than 30% ahead of the open after the company announced it was withdrawing its 2025 guidance.

- The U.S. Dollar Index ($DXY) remains near recent three-year lows. "Expectations for slower growth, lower inflation, lower forward rates, and shifting preferences for non-U.S. investment are driving the dollar lower," said Schwab's Jones. "A lower dollar adds to inflation pressure."

- As of early Wednesday, odds of a July rate cut were 25%, according to the CME FedWatch Tool, up from 20% yesterday after the ADP jobs data. The likelihood of at least one rate cut by September was 98%.

- Technically, the S&P 500 index saw a positive development on the charts yesterday as its 50-day moving average climbed above the 200-day moving average for the first time since early April.

More insights from Schwab

Inside the "One Big Beautiful Bill": Learn more about the legislation and how it might affect markets and the economy in the latest analysis from Schwab's Townsend. The article also discusses next steps and chances for House passage. "With a narrow 220-212 majority in the House and Democrats unified in opposition, Republicans can have only three defections and still be able to pass the bill," Townsend noted.

" id="body_disclosure--media_disclosure--125471" >Inside the "One Big Beautiful Bill": Learn more about the legislation and how it might affect markets and the economy in the latest analysis from Schwab's Townsend. The article also discusses next steps and chances for House passage. "With a narrow 220-212 majority in the House and Democrats unified in opposition, Republicans can have only three defections and still be able to pass the bill," Townsend noted.

Rate cuts not a guaranteed panacea: There's no guarantee a near-term rate cut would ease borrowing costs. "If the Fed cuts rates too soon, it would likely raise inflation expectations, which could move intermediate- to long-term rates higher, especially in an environment where the supply of Treasuries is likely to keep rising due to increased spending," Schwab's Jones said in the latest Schwab analysis.

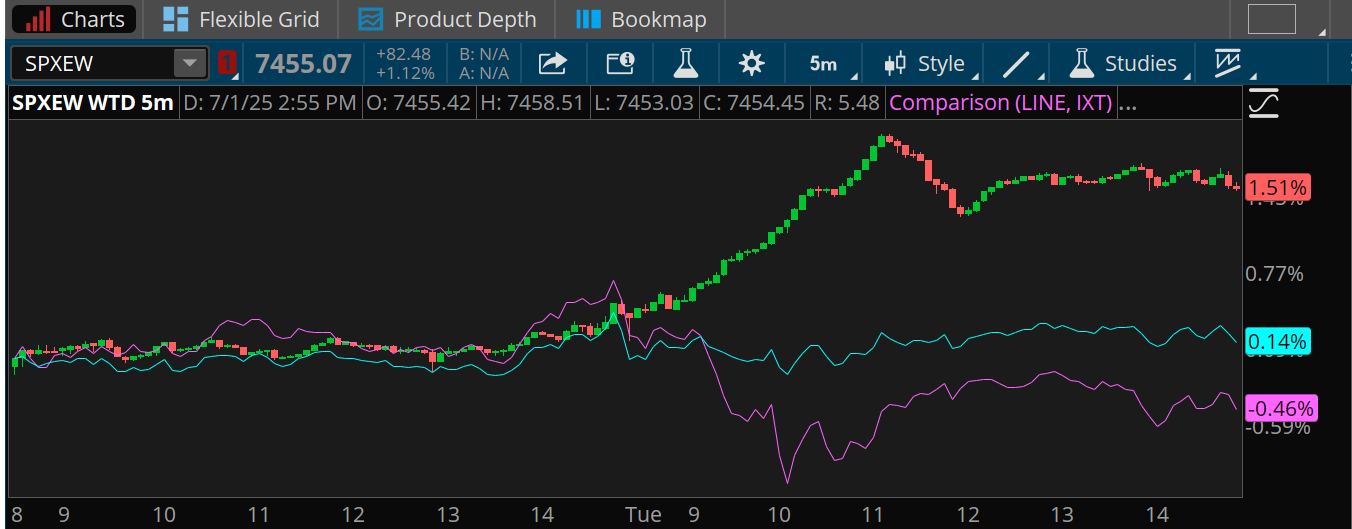

Chart of the day

Data source: S&P Dow Jones Indices. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Many investors likely were disappointed by yesterday's soft S&P 500 index (SPX—blue line) and tech sector (IXT—purple line) performance, with this week-to-date chart showing both of them flat to lower Monday and Tuesday. But the drop in tech starting early Tuesday correlated in timing with a moderate gain for the S&P 500 Equal Weight index (SPXEW), which consists of the same stocks as the SPX but weighs all of them equally rather than by market capitalization. With most stocks outside of tech and communication services rising yesterday, the equal weight index performed well, showing relatively broad strength across the market and reflecting a possible first day of the quarter rotation out of the sectors that worked best in the second quarter. The question is whether this continues or was just a brief pause for tech.

The week ahead

Check out the Investors' Calendar for a summary of the top economic events and earnings reports on tap this week.

July 3: June nonfarm payrolls, June unemployment, June ISM Services PMI®, May factory orders, markets close early ahead of holiday.

July 4: Markets closed for Independence Day.

July 7: No major earnings or data expected.

July 8: No major earnings or data expected.

July 9: FOMC minutes.