What Happened to Germany's Spending Boom?

Despite announcing a massive stimulus program in early 2025, fiscal spending and economic growth in Germany have disappointed. However, we believe the economic boost to Germany and Europe has been delayed, not denied. Germany's defense and infrastructure spending super-cycle has just begun.

Delay to 2025 spending

In response to U.S. threats to reduce Europe's security guarantees via NATO, tariff increases, as well as voter dissatisfaction with domestic economic growth, Germany ended decades of fiscal conservativism in the spring of 2025. Lawmakers passed legislation for a multi-year spending spree focused on defense and infrastructure. The spending could result in an estimated 1-trillion-euro spending plan through a 500-billion-euro infrastructure fund and an increase in defense spending from 2% to 3.5% of gross domestic product (GDP) by 2029.

Unfortunately, new discretionary spending was on hold until the 2025 budget could be passed. The government had been operating under emergency budget measures until the 2025 budget was passed on September 18th. The 15% increase in approved spending relative to 2024 could imply a sharp uptick in activity for the final quarter of 2025. However, this may be constrained given the short time frame and lengthy permitting and planning processes for spending on the targeted areas of defense and infrastructure.

Fiscal spending to pick up in 2026 and beyond

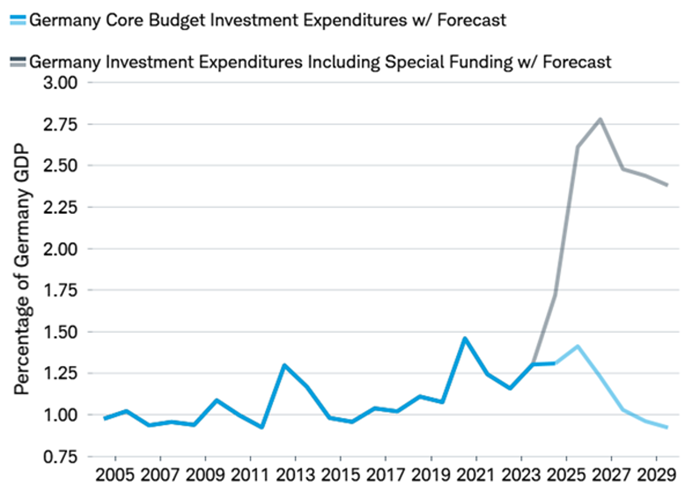

Fiscal spending in Germany is expected to pick up next year; officials are preparing the 2026 budget and hope to pass it in late December. The medium-term fiscal plan through 2029 suggests government investment as a percentage of GDP including special funds under the new legislation surges from 1.3% in 2024 to 2.8% in 2026.

German government investment expected to grow

Source: Charles Schwab, German Ministry of Finance, BCA Research projections as of 10/21/2025.

Shaded lines are forecasts. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

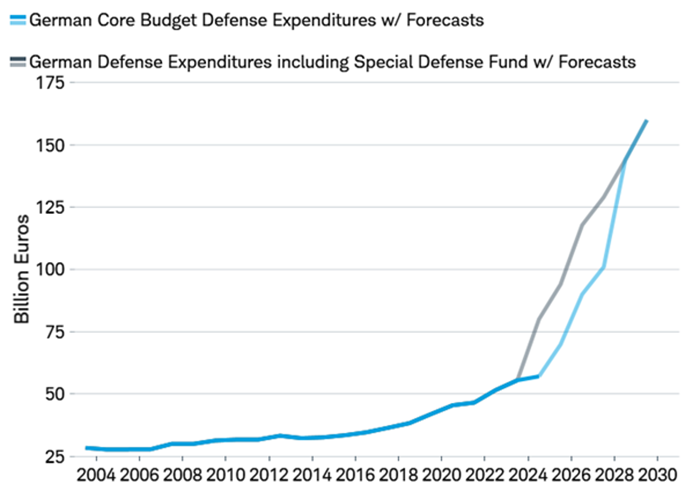

Defense spending including off-budget special funds allocated through 2027 is expected to rise from 94 billion euros in 2025, to 162 billion euros in 2029, a 72% increase.

Rapid increase in German defense spending forecasted

Source: Charles Schwab, Germany Ministry of Finance, as of 10/31/2025.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Economic ripples through Europe

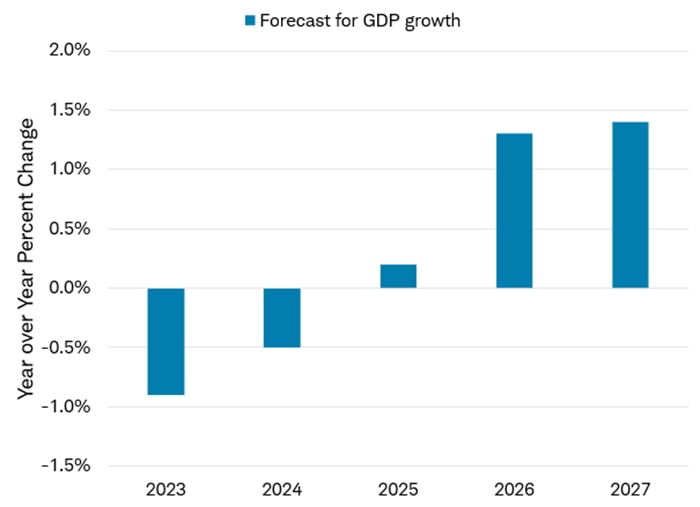

Economic growth in Germany is expected to accelerate due to the expansion in fiscal spending, pivoting from contraction in 2024 to nearly flat in 2025, and is expected to continue to pick up speed in 2026 and 2027, according to the German Institute for Economic Research.

Growth in Germany is expected to pick up speed

Source: Charles Schwab, German Federal Statistics Office, German Institute for Economic Research, as of 9/25/2025.

Actual growth shown for 2023 and 2024, forecast for 2025-2027 provided by the German Institute for Economic Research. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

The broader economy is likely to benefit from the defense and infrastructure spending. Spending on defense may generate new technology and encourage private sector research and development, which has the potential to increase worker productivity. Spare capacity in the industrial sector could be repurposed to rebuild Germany's military capabilities. It's not just Germany–NATO as a group agreed to increase spending from 2% of GDP to 5% of GDP by 2035, per the Hague Summit Declaration of June 2025. Infrastructure spending by Germany to improve roads and bridges, lay rail tracks and high-speed fiber-optic internet can increase economic efficiency.

Germany is Europe's largest economy, which means any improvement in its economic growth has the potential to spill over into Europe as a whole via purchases from defense contractors outside of the country, job growth, and consumer and business spending.

Structural reform opportunities

German Chancellor Friedrick Merz has promised an "autumn of reforms." His proposals include reforms to pensions, a diversified energy policy to secure supply for Germany's industrial base, and social welfare changes to move more adults into the workforce.

Merz has already undertaken efforts to make Germany a more attractive place to do business by cutting regulatory and administrative red tape, reducing corporate taxes and energy costs for large manufacturers. The measures so far have been small and at the margins, leaving the opportunity for further transformation, including increasing its digital competitiveness.

Germany's push to improve competitiveness could be contagious. Merz called for the creation of a pan-European stock exchange in mid-October, which could move the region to a closer capital markets union with less regulation. This prompted European Central Bank President Christine Lagarde to call Germany a potential "agent of change."

Potential constraints

Increased fiscal spending has the potential to improve growth in both Germany and Europe, but it may unfold at a slower-than-expected pace. Infrastructure spending has implementation risk, as it has tended to underdeliver relative to targets in recent years. Already the 2025 budget allocated less to infrastructure than initially planned at the start of the year, having shifted money to social spending and electricity subsidies for businesses. Bureaucratic delays due to infighting within the German parliament, as well as a shortage of skilled labor, could also slow spending. Positively, legislation underway to accelerate military procurement and investment could improve the speed of spending in 2026 and beyond.

Germany's economic growth has been threatened by new U.S. tariffs in 2025 and increased competition from Chinese firms. Defense spending may need to rely on imports, including those from U.S. defense contractors. GDP growth is reduced when imports grow. Lastly, Germany's electricity costs remain high despite increased access to liquefied natural gas (LNG)–improvements to its grid and energy pricing would boost industrial competitiveness. Lower electricity prices will likely grow in importance to support data center usage by artificial intelligence (AI).

Investment implications

Germany's historic shift in attitude toward fiscal spending this year has the potential to boost growth. Spending has been slow to develop but could be more impactful in late 2025 and into 2026. Germany's shift in attitude may also result in structural reforms, with potential positive ripple effects in Europe as a whole.

Valuations in Europe are supportive, with the MSCI EMU Index trading at 14.8x next-12-months earnings as of October 20th, a slight premium to the 10-year average of 13.9x, but well below the 22.5x comparable valuation for the S&P 500. If economic and earnings growth accelerates, European stocks could respond positively.

The uptick in defense spending in Germany and elsewhere is catalyzed by global structural changes, likely providing a durable investment theme. While the MSCI EMU Aerospace and Defense Index is up 78% through October 30, European defense stocks could rise further if defense expenditure continues to grow. Downside risk is possible if spending fails to meet what appears to be elevated investor expectations.