U.S. bonds can be a great way to tap into fixed income investing.

When it comes to investing in the U.S. bond market, there are a number of ways to get started and a wide variety of institutions that issue fixed income securities, including the U.S. government, state and local governments, and publicly held companies.

Discover the right U.S. bonds for your financial goals with Schwab.

Explore a wide selection of bonds from a variety of issuers, all backed by Schwab's transparent pricing and expert tools.

Whether you're seeking municipal bonds, treasury bonds, or corporate bonds, Schwab BondSource® gives you access to thousands of choices—at the best price available to Schwab. With thousands of bonds to choose from, and powerful resources like independent research and daily market updates, Schwab makes it easy to find the perfect fit for your portfolio.

Complex bond restriction

Complex bonds are bonds comprising one or more special features (e.g., variable- or deferred-interest payment terms). Below are examples of complex bonds that are generally restricted for customers of Schwab Hong Kong. If you have questions on the restrictions, please contact us at +852 2101 0500.

- Corporate Bonds: Convertible, Subordinated1, Perpetual

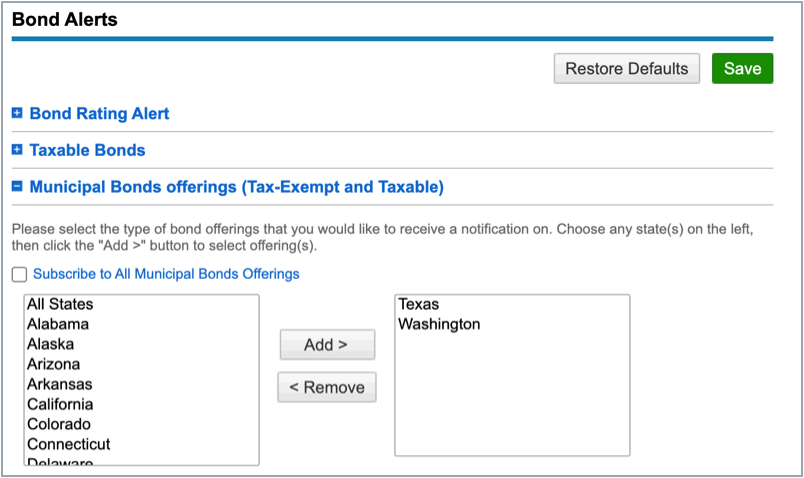

- Municipal Bonds

- Unit Investment Trust (UITs) (Non-Exchange Traded)

- Collateralized Mortgage Obligations (CMOs)

- Asset-Backed Securities

- Mortgage-Backed Securities

- Preferred Bonds and Convertible Preferred Bonds

- Variable-Rate Bonds

- Foreign Regulated Investment Company Bonds

- Non-Investment Grade Bonds

- Extendable Maturity Date (soft bullets) Bonds

1. Charles Schwab Hong Kong has defined corporate subordinated bonds as Senior Subordinated, Subordinated, Junior, Junior Subordinated, and Undefined.

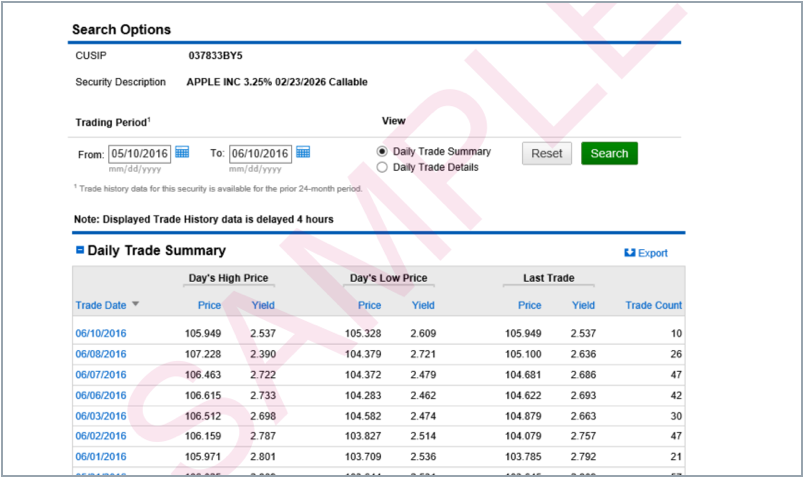

Our powerful tools can help you research and trade U.S. bonds.

Get a balanced perspective on the U.S. bond market with timely insights and third-party research.

In addition to daily market updates and ongoing global commentary, Schwab offers premium independent research from Briefing.com, Credit Suisse, and others.

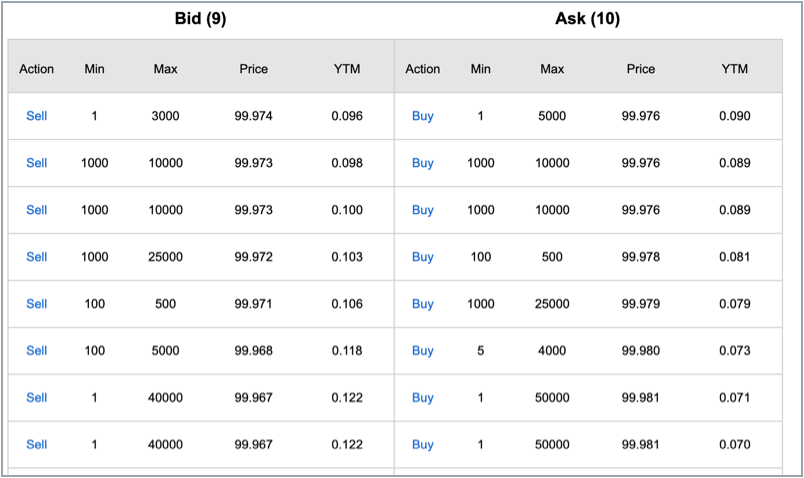

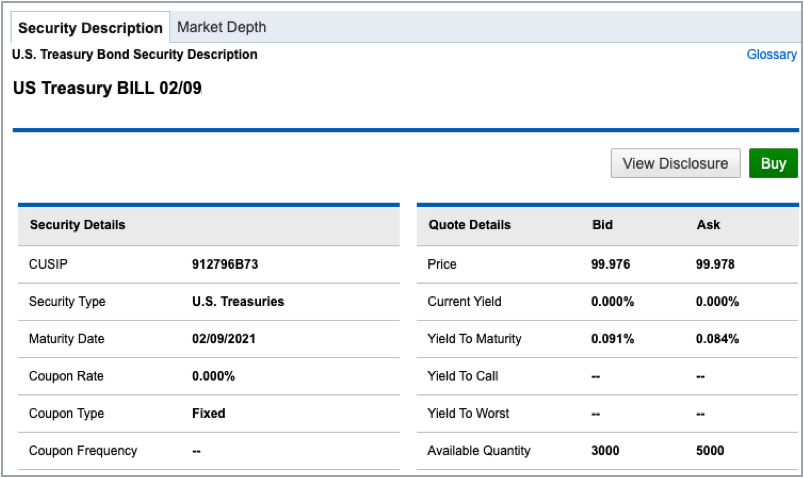

Get straightforward pricing that is disclosed before you buy a bond.

At Schwab, there's no mystery about our pricing. It’s straightforward, simple to understand, and provides a great value.

U.S. Bonds FAQs

The safety of U.S. bonds depends on the issuer. Treasury bonds are among the safest since payment of principal and interest is backed by the U.S. government. Municipal bonds, issued by states and local governments, are generally safe as they are typically backed by taxes or user fees from services that are often essential, but it depends on the issuer's creditworthiness. Corporate bonds can offer higher yields than those offered by other fixed income securities with similar maturities, but with greater risk of loss.

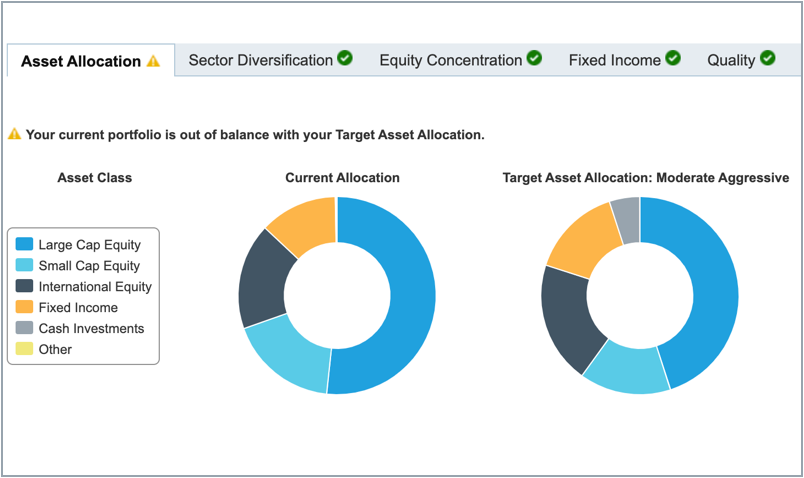

U.S. bonds can provide a measure of stability and the potential for steady income through interest payments. Bonds can also help diversify an investment portfolio, potentially reducing overall risk.

The minimum investment for U.S. Treasury bonds is 1 bond or $1,000 face value. Municipal and corporate bonds typically require a minimum of around $1,000, though this varies by issuer.

Due to some bonds being classified as complex, Schwab Hong Kong has restricted the trading of these complex bonds. You may be able to locate these bonds on the trading platform, but attempting to place an opening trade will result in an instant order rejection. For a list of bond categories that are defined as complex, please see complex bond restriction section above. If you are having difficulties identifying which bonds are complex, please give our dealing desk a call.

Start investing in the U.S. today.

-

Start investing in the U.S. markets today.

Have more questions? We're here to help.

-

Call

CallNew customers

+852-2101-0511

Monday-Friday, 9:00 am to 6:00 pm (HK Time)Existing customers

+852-2101-0500

Monday 5:30 am – Saturday 1:00 pm (HK Time) -

Email

Email -

Visit us

Visit usCharles Schwab, Hong Kong, Ltd.

Room 3401, 34th Floor, Gloucester Tower,

The Landmark, 15 Queen's Road Central, Central, Hong KongOffice hours

Monday-Friday, 9:00 am to 6:00 pm (HK Time)